Table Of ContentINCLUDES

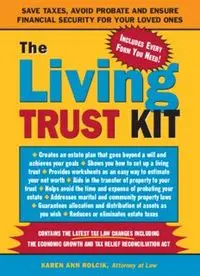

SAVE TAXES, AVOID PROBATE AND ENSURE

EVERY FORM

Doesn’t Your Family Deserve More? YOU NEED! FINANCIAL SECURITY FOR YOUR LOVED ONES

◆ Did you know that the government may be

The

able to take nearly half of the assets you

The

leave your family?

◆ Did you know that your family could have to

wait to access the funds you saved for them?

A Living Trust can do so much more than a will to ensure that money

is not lost or wasted, to kep your family out of court and to kep Living

creditors away. Let The Living Trust Kit teach you all the advantages

a Living Trust offers.

A Living Trust is inexpensive to create, easy to maintain and:

◆ limits creditor claims ◆ permits flexibility

TRUST KIT

◆ensures privacy ◆ is difficult to contest

◆ prevents unintended ◆ maintains continuation

disinheritance of business

◆ Creates an estate plan that goes beyond a will and

◆ minimizes emotional stress ◆ controls assets during

on family incapacity achieves your goals ◆ Shows you how to set up a living

◆ directs timely distribution ◆ provides a guardianship

trust ◆ Provides worksheets as an easy way to estimate

of assets alternative

◆ avoids probate and ancillary ◆ allows for continuity of asset your net worth ◆ Aids in the transfer of property to your

probate administration management and income flow

trust ◆ Helps avoid the time and expense of probating your

estate ◆ Addresses marital and community property laws

NO OTHER TOOL CAN DO MORE TO SAVE YOU ◆ Guarantees allocation and distribution of assets as

MONEY AND PROTECT YOUR FAMILY! you wish ◆ Reduces or eliminates estate taxes

SPHINX® PUBLISHING

AN IMPRINT OF SOURCEBOOKS, INC.® Personal $21.95 U.S. CONTAINS THE LATEST TAX LAW CHANGES INCLUDING

NAPERVILLE, ILLINOIS Finance $32.95 CAN

www.SphinxLega l . com THE ECONOMIC GROWTH AND TAX RELIEF RECONCILIATION ACT

KAREN ANN ROLCIK, Attorney at Law

INCLUDES EVERY

FORM YOU NEED!

Living TRUST KIT ROLCIK

SAVE TAXES, AVOID PROBATE AND ENSURE FINANCIAL SECURITY

UPC

EAN

THE

LIVING TRUST

KIT

Save Taxes, Avoid Probate,

and Ensure Financial Security

for Your Loved Ones

By Karen Ann Rolcik

Attorney at Law

®

SPHINX PUBLISHING

AN IMPRINT OF SOURCEBOOKS, INC.®

NAPERVILLE, ILLINOIS

w w w. S p h i n x L ega l . c o m

Copyright © 2004 by Karen Ann Rolcik

.™

Cover design © 2004 by Sourcebooks, Inc

All rights res e r ved. No part of this book may be rep r oduced in any form or by any electronic or mechan-

ical means including information storage and ret r i e v al systems—except in the case of brief quotations

embodied in critical articles or rev i e ws—without permission in writing from its publisher, Sou r ce b o o k s ,

Inc. Pur chasers of the book are granted a license to use the forms contained herein for their own per-

sonal use. No claim of copyright is made to any official government forms rep r oduced herei n .

First Edition, 2004

® ®

Published by: Sphinx Publishing, A Division of Sourcebooks, Inc.

Naperville Office

P.O. Box 4410

Naperville, Illinois 60567-4410

630-961-3900

Fax: 630-961-2168

www.sourcebooks.com

www.SphinxLegal.com

This publication is designed to provide accurate and authoritative information in regard to the sub-

ject matter covered. It is sold with the understanding that the publisher is not engaged in rendering

legal, accounting, or other professional service. If legal advice or other expert assistance is required,

the services of a competent professional person should be sought.

From a Declaration of Principles Jointly Adopted by a Committee of the

American Bar Association and a Committee of Publishers and Associations

This product is not a substitute for legal advice.

Disclaimer required by Texas statutes.

Library of Congress Cataloging-in-Publication Data

Rolcik, Karen Ann.

The living trust kit : save taxes, avoid probate, and ensure financial security for

your loved ones/ by Karen Ann Rolcik.-- 1st ed.

p. cm.

ISBN 1-57248-449-7 (pbk. : alk. paper)

1. Living trusts--United States--Popular works. I. Title.

KF734.Z9R64 2004

346.7305'2--dc22

2004019172

Printed and bound in the United States of America.

VHG — 10 9 8 7 6 5 4 3 2 1

D E D I C AT I O N

This book is dedicated to my two greatest sources of inspiration—my mother

and my father. They have been stalwarts—always giving encouragement, sup-

port, insight, and love. From them I learned the importance of family, giving of

myself, and sharing with others.

Now that Dad has gone to be with the saints, Mom has given of herself—

twofold. Dad, I miss you everyday. Mom, I love you more everyday.

Contents

Using Self-Help Law Books . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . ix

Introduction. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . xiii

Chapter 1: Probate

The Good, The Bad, and The Ugly . . . . . . . . . . . . . . . . . . . . . . . . . . . 1

Understanding the Probate Process

Understanding when Probate is Necessary

Property Subject to Probate

The Role of Your Will in the Probate Process

Disadvantages of Probate

Advantages of Probate

Conclusion

Chapter 2: Probate Alternatives and Beneficiary Designations

Side Stepping the Probate Process. . . . . . . . . . . . . . . . . . . . . . . . . . . 15

Benefits of Probate Alternatives

Dangers of Probate Alternatives

Methods of Holding Title to Assets

Community Property

Transfers of Property by Contract

Gifts

vi The Living Trust Kit

Chapter 3: Estate and Inheritance Taxes

Is Uncle Sam a Beneficiary of Your Estate? . . . . . . . . . . . . . . . . . . . . 31

Federal Estate Tax

Planning to Reduce Your Estate Tax Burden

Chapter 4: Living Trusts

The Nuts and Bolts . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 37

Trusts

Trust Types

Parties to a Trust

Living Trust Advantages

Living Trust Disadvantages

Chapter 5: Your Assets

What Do You Have and How Much Do You Have? . . . . . . . . . . . . . . 51

Calculating Your Net Worth

The Worksheet

Identify Your Assets

Retirement/Employment Related Plans

Identify Your Liabilities

Calculate Your Net Worth

Net Worth Worksheet

Net Worth Summary

Personal Contacts Worksheet

Chapter 6: Creating Your Living Trust

Putting It All into Action. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 67

The Trustee

The Beneficiaries

Executing Your Living Trust

Amending the Living Trust

Revocation of the Living Trust

Chapter 7: Funding Your Living Trust

If You’ve Got It, Fund It!. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 85

Deciding which Property to Transfer

Title

Taxpayer Identification Number

Asset Ownership

Transferring Assets to Your Living Trust

Living Trust Recordkeeping

Contents vii

Chapter 8: Estate Tax and Probate Savings of Living Trusts

You Earn It, You Keep It!. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 95

I Love You Wills

Case Studies

Estate Tax Planning with Living Trust

Family Trust Appreciation

Guardianships—the Living Probate

Chapter 9: Ancillary Documents to Avoid Living Probate

Complete Your Planning with All the Documents You Need. . . . . . . 105

Powers of Attorney—Guardianship Alternatives

Declaration of Guardian in Advance of Need

Designation of Guardian for Minor Children

Chapter 10: Administration of Your Living Trust after Your Death

The Final Steps. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 111

Obtain Death Certificates

Gather Personal Information

Contact Social Security Administration

Safe Deposit Box

Obtain Tax Identification Number for Trust

Contact Life Insurance Companies

Inventory Assets

Identify Debts of Decedent

Final Income Tax Return

Trust Income Tax Returns

Distribution of Assets to Beneficiaries

Epilogue . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 117

Glossary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 119

Appendix A: Tax Explanations and Charts . . . . . . . . . . . . . . . . . . . . . . . . . . . 131

Appendix B: State-by-State Laws. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 135

Appendix C: The Design of the Forms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 149

Appendix D: Blank Forms . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 159

Index . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 353

About the Author . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 359

Using

Self-Help

Law Books

Before using a self-help law book, you should realize the advantages and disad-

vantages of doing your own legal work. You should also understand the chal-

lenges and diligence that doing your own legal work requires.

The Growing Trend

Many people have decided that they want to handle their own legal matters.

This may range from writing their own will, incorporating a business, manag-

ing their divorce, handling landlord/tenant issues, or representing themselves in

small claims court. In some states, more than seventy-five percent (75%) of

divorces and other cases have at least one party representing him- or herself.

The reason for this growing trend is the rising costs of legal services. Courts

struggle to make it easier for people to represent themselves. There are, howev-

er, judges that frown upon people who do not use an attorney. Judges and

courthouse staff cannot give legal advice and therefore must be very careful as

to what information they give to individuals who are handling their own legal

matters. There are some judges that have established their own rules about par-

ties representing themselves. In some courts,the judges simply do not allow it—

They require that all parties use attorneys. This is unfair and, in the opinion of

many people, violates not only state law but also the United States Constitution.

At Sphinx, self-help books are written to give people an alternative to the often

complicated and confusing legal books found in most law libraries.Our authors

strive to make the explanations of the law as simple and easy to understand as

possible. Of course, it is impossible for every situation to be addressed.