Table Of Content13 April 2015

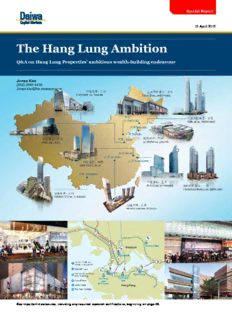

The Hang Lung Ambition

Q&A on Hang Lung Properties’ ambitious wealth-building endeavour

Jonas Kan

(852) 2848 4439

[email protected]

See important disclosures, including any required research certifications, beginning on page 46.

The Hang Lung Ambition

13 April 2015

Contents

Q1 Are commercial properties in China worth owning? 1

How much value can systematic and professional

Q2 13

management create for retail properties?

Is HLP a credible vehicle through which to play the

Q3 emergence of premier retail property managers in 19

Greater China?

Are there aspects of this ambitious wealth-building

Q4 33

exercise that have been overlooked?

Company section: Hang Lung Properties 41

Please also see:

Swire Properties: more on the Cheung Kong/Hutch’s Bold Move: The Hong Kong Property Toolkit:

‘nurturing reward’ Q&A on the prospect of the group A step-by-step guide to the past,

becoming a global play, with a present and future of the Hong Kong

valuation to match Property Sector

10 April 2015 9 February 2015 Autumn 2013

Jonas Kan, CFA (852) 2848 4439 Jonas Kan, CFA (852) 2848 4439 Jonas Kan, CFA (852) 2848 4439

([email protected]) ([email protected]) ([email protected])

The Hang Lung Ambition

13 April 2015

Contributing Daiwa

Thoughts on HLP’s ambitious wealth-building

Analyst:

endeavour

About 10 years ago, HLP embarked on an ambitious wealth-building venture

in the property space, entailing utilising the over HKD20bn in profit it stands

to realise from Hong Kong’s residential property sector to fund a series of

ambitious investments in China in an attempt to transform itself into a

leading player in the commercial property sector in Greater China.

Jonas Kan, CFA

(852) 2848 4439 That this is a special endeavour deserving investors’ attention is not in

[email protected]

doubt, but how this ambition has been priced into HLP shares has changed

in recent years. That is to say, from 2005-11, HLP traded like a rising star in

global property, but since then, its valuation has been notably derated.

Although the company’s gross rentals and BVPS rose at decent CAGRs of

12% and 6%, respectively, from 2011-14, its current share price of

HKD24.15 represents a 40% drop from its peak of HKD40.30 in 2010.

In this report, we spell out our thoughts on the major issues relating to the

sector and HLP itself that we think investors should consider in assessing

whether HLP’s shares are undergoing a structural derating, or now

represent a rare opportunity to buy into an ambitious, yet safe and reliable

vehicle through which to play the long-term potential of prime commercial

property assets in Greater China.

This report comes after our 9 February publication on Cheung Kong

Group’s latest reorganisation, which we believe could attract global investor

interest in Hong Kong family business groups, including HLP, all of which

are trading at notable discounts to the market values of their property and

business assets. A special aspect to HLP is that its strategy is probably the

most simple and focused of the Hong Kong family business groups, and that

the value-creation potential associated with professional and systematic

management of retail property assets which has already been well-

demonstrated by various premier names in global property is something we

expect to see at HLP.

In what follows, we attempt to help investors understand what we see as the 4

major questions pertaining to the commercial property sector in Greater

China, and to HLP as a vehicle through which investors can obtain exposure

to this area.

Jonas Kan, Head of Hong Kong and China Property

The Hang Lung Ambition

13 April 2015

The HHang Lunng Ambition

13 April 22015

Quuesstioon 1

AAre commmerrcial proopertties in Chinaa

worthh owwningg?

- 1 -

The Hang Lung Ambition

13 April 2015

Q1: Are prime commercial properties in China worth owning?

Notwithstanding the various concerns associated with the China commercial property sector, such as over-supply,

the lack of a sizeable middle class and office-based employment in China, we contend that there are assets in this

sector that are worth owning. However, we would hasten to add that investors should be selective in their choice of

asset and take a long-term view. We advocate focusing on property companies that have developed – or are in the

process of developing – the specialised skills needed to preserve or enhance the value of their commercial

properties over time, and on those that already have (or are in the process of accumulating) a critical mass of

income-producing assets in China, capable of expanding their portfolios without putting excessive strain on their

balance sheets.

In general, we see prime commercial properties as an asset class that benefits from an expanding population, and

the wealth and economic prosperity of any city; and as we see it, China is no exception to this. Generally, a safe

and attractive way to play the rise of a large, populous and growing economy is to own prime commercial

properties, and in our view, China is no exception.

Commercial properties are essentially property assets used by corporations, retailers, etc., for commercial activities

– be it retailing or office-based business activities. (Note that we consider hotels and serviced apartments as

comprising a different type of property asset class, and hence, refer only to retail and office property assets in this

discussion on commercial property.) Generally, the rise in wealth and population of a city leads to an increase in

total retail spending in that city. Similarly, the rise in the level of office-based economic activities and corporate

profit also normally results in an increase in the total rents that can be paid by the corporations in that city, which in

turn, exerts upward pressure on the aggregate capital value of the commercial property assets in that city. In this

light, it would follow that the total market value of China’s commercial property sector should become very large, as

long as the country’s economy continues to expand.

China: number of cities by population

Population Number

Over 10m 12

5-10m 75

1-5m 214

301

Source: China Statistical Year Book, CEIC

Major cities in China in terms of population

(m)

1,37700

1,36600 1,360

50

40

30

20

10

0

hina - overall Chongqing Shanghai Beijing Tianjin Chengdu Guangzhou Shenzhen Suzhou Shijiazhuang Wuhan Harbin Wenzhou Zhengzhou Qingdao Hangzhou Xi'an Nanjing Ningbo Hefei Changchun Fuzhou Shenyang Nanning Changsha Jinan Kunming Wuxi Dalian Nanchang Guiyang Taiyuan

C

Source: Datastream, Daiwa

Notwithstanding the sizeable aggregate value of commercial property assets in China, the sector faces a number of

challenges, particularly as relates to per-square-foot rentals and capital values. In our opinion, there are 3 features

that make commercial property in China a challenging sector to play.

- 2 -

The Hang Lung Ambition

13 April 2015

First, most of China’s major cities are located on flat land, which means that the size of these cities can continue to

expand as “more rings” are added to the geographical spread of these cities. Take Beijing as an example. The total

size of the city has expanded exponentially compared with the early 1980s, with the city having growth outward to

form a sixth ring, with more in all likelihood to come over time. According to the China Statistical Yearbook, in 2014

there were at least 19 cities in China that were are larger than 10,000sq km (to give some context, Hong Kong

occupies about 1,000sq km in terms of area).

China’s 4 Autonomous municipalities and provincial capitals

Provincial capitals Population (m) City area (sq km)

Shanghai* 24.2 6,340

Beijing* 21.1 16,411

Tianjin* 14.7 11,917

Chongqing* 29.7 82,374

Guangzhou 12.9 7,249

Hangzhou 8.8 16,571

Nanjing 8.2 6,587

Jinan 7.0 8,177

Changsha 7.2 11,816

Chengdu 14.3 12,121

Fuzhou 7.3 13,066

Wuhan 10.2 8,494

Hohhot 3.0 17,200

Zhengzhou 9.2 7,446

Taiyuan 4.3 6,977

Shenyang 7.3 12,980

Shijiazhuang 10.5 15,848

Changchun 7.5 20,604

Nanchang 5.2 7,402

Harbin 10.0 53,068

Guiyang 4.5 8,034

Hefei 7.6 11,445

Xi'an 8.6 10,108

Kunming 6.6 21,012

Haikou 2.2 2,305

Urumqi 2.6 13,788

Lhasa 0.5 29,518

Nanning 7.2 22,112

Yinchuan 2.1 8,874

Lanzhou 3.6 13,086

Xining 2.0 7,665

Source: CEIC

*the 4 autonomous municipalities

Second, based on our market research , many provincial and local governments see high-rise office buildings and

upmarket shopping malls as “symbols of prosperity” and, hence, generally have a tendency to supply the market

with abundant land to develop into commercial properties, without paying sufficient attention to whether there is

sufficient economic demand for them. Indeed, it is not uncommon for local governments to “subsidise” the

developers to embark on commercial property projects by granting them lower-cost residential GFAs, so that the

developers can make enough profit on the residential proportion of these projects to fully fund the construction of

the large commercial property complexes next to them. As a consequence, it is typical for many cities in China to

have several CBDs.

The third factor is related to the mechanism for allocating capital in China. In many other markets around the world,

the availability of capital tends to be a powerful factor restraining the construction and completion of unproductive

property projects. However, in China, such a restraint has not been as effective, probably because China’s

economy started off as a command economy, and probably still is to a large extent. Note that over 50% of China’s

GDP comes from fixed asset investments, and over the past 17 years, China’s M2 has expanded at a CAGR of 17%

per year, resulting in a situation where China’s M2 at the end of 2014 was USD19.7tn, 70% larger than that of the

US.

- 3 -

The Hang Lung Ambition

13 April 2015

China: M2

(CNYbn)

140,000

120,000

100,000

80,000

60,000

40,000

20,000

0

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

Source: CEIC

But what compounds the situation further is that in China, it is arguable that capital has not been properly priced in

the past, such that some large SOEs or other entities have easier access to capital from the banks, and may not

bother that much about the returns on that capital. What makes matters worse is that creating more CBDs helps

the sale of land, which is often one of the largest sources of capital for many local governments. As a result, while

demand for commercial property in China is growing, the supply of commercial property space is also increasing.

Compared with existing stock levels, we estimate that the annual supply of commercial property space in many

cities in China could be in the magnitude of 40-50% of the existing stock, which is certainly a recipe for a near-term

supply-and-demand imbalance.

To arrive at a balanced view on China’s commercial property sector, however, we believe there are at least 3

considerations that need to be taken into account.

1) The total commercial property stock in China’s major cities does not yet appear to have reached a

size that exceeds what those cities’ economies can support in the future. While there is a major

oversupply of commercial property space in China at this point and, this is likely to continue in the near future, if

China can grow to become an economy that rivals the US in size, and if the importance of its service sector

becomes comparable to that of mature Western economies, then this over-supply would not be permanent.

Note that New York and London have grade-A office stock of well over 20m sq m currently, based on figures

from DTZ, while that for Beijing and Shanghai is still below 10m sq m. Note also that cities like Chicago, San

Francisco and Toronto have grade-A office stock of over 5m sq m, while the corresponding grade-A office stock

amounts for the largest provincial capitals in China are still in the 1-3m sq m range.

Looked at in this light, the over-supply issue in China’s commercial property sector could partly be a

“digestion problem” resulting from some of China’s cities trying to achieve within just a few years what has

taken New York, London and many other cities much longer.

Grade-A office stock for the world’s major international cities

((mm ssqqmm))

25

20

15

10

5

0

Tokyo (Central 5 Wards) New York (Manhattan) London (Central) Hong Kong Shanghai

Source: DTZ, Daiwa

- 4 -

The Hang Lung Ambition

13 April 2015

Grade-A office stock for China’s main cities

(m sq m)

9

8

7

6

5

4

3

2

1

0

Beijing Shanghai Shenzhen Guangzhou Chongqing Chengdu Shenyang Qingdao Hangzhou Nanjing

Source: Savills

2) There are factors that could restrain the increase in the number of major cities in China and the size

of their core city areas. Judging from the history of how cities globally have developed, very often, growth

in demand for city space has tended to result more in the expansion in size of an established major city,

rather than the continued emergence of new cities. Even for an economy as large as the US, we would say

that the number of major US cities is probably not a lot more than 10 – New York, Boston, Chicago, Los

Angeles, San Francisco being among them.

In China, because of the diversity of its population, geography and culture, as well as the central

government’s policy to promote the greater distribution of economic prosperity and opportunities

throughout the country, we believe the country will eventually surpass the US in having more major cities.

But we would not see the number of its cities that are of considerable importance to the country as whole

not being much more than 20. If this is the case, then it would be mainly down to about 20-30 cities to meet

China’s entire demand for commercial property space.

Daiwa’s selection of the 20 major cities in China for commercial properties

Source: Daiwa

- 5 -

The Hang Lung Ambition

13 April 2015

Our observation is that pretty much none of the cities in China have robust and sophisticated long-term

town-planning driving their development. This means that the continued expansion of the nation’s cities is

likely to continue to put a strain on their social infrastructure, in particular, transport and housing. This in

turn implies that the geographical expansion of many cities in China would be constrained at some point.

Over time, we can see a situation developing whereby there is a hierarchy of cities in China, with one major

city being supported by many satellite cities in surrounding areas and, that together, they will form a large

metropolitan area, linked by efficient and modern highways and high-speed rail. It would follow then that

prime commercial properties in China’s top-20 cities would be in a better position than those in cities

outside the top 20, even though over-supply could be a lasting issue in many peripheral satellite cities.

China’s high-speed railway network

Source: Daiwa

3) Some companies and retailers should have sufficient rent-paying capability. We note that currently a

rental budget of HKD3-5/sq ft would allow a corporation to rent almost any office building in China, with the

exception of a handful of the most prime office buildings in Beijing and Shanghai. And in our view, USD3-

5/sq ft should be affordable for many international corporations as many have been paying office rents at

similar or higher levels in other cities. In Hong Kong for example, rents for prime grade-A offices in Central-

Wanchai-Causeway Bay range from USD5-20/sq ft; and based on our industry research, in London, rents

in the West End and the Bank area range from USD5-18/sq ft. Our understanding is that many cities have

office buildings commanding rents of over USD5/sq ft. If these cities can find corporations that are willing to

pay USD5/sq ft or more for some of its office buildings, we do not see why this cannot happen in China.

As for retail rents, we believe there are retailers that can achieve sales per sq ft of USD500 or more in their

stores in China, which would be a respectable level by global standards. Note that for many international

retailers, the achieved sales price for their merchandise in China is often 20% or more higher than it is in

Hong Kong, and globally on average. Thus, it would seem that at least some retailers could afford to pay

- 6 -

Description:Daiwa's selection of the 20 major cities in China for commercial properties. Source: Daiwa. 0. 1. 2. 3. 4. 5. 6. 7. 8. 9. Beijing. Shanghai. Shenzhen 16.61. Shares outstanding (m). 4,479. Major shareholder. Hang Lung Group (52.9%). Financial summary (HKD). Year to 31 Dec. 15E. 16E. 17E. Revenue