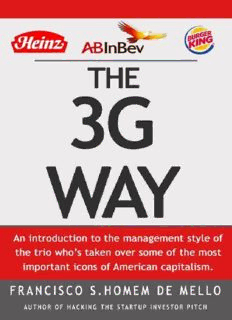

Table Of ContentThe 3G Way

An introduction to the management style of the trio who’s

taken over some of the most important icons of American

capitalism.

Francisco S. Homem de Mello

Copyright © 2014 Authored By Francisco Souza Homem de Mello

All rights reserved.

ISBN: 0990457516

ISBN 13: 978-0990457510 (Ajax Books)

Library of Congress Control Number: XXXXX (If applicable)

LCCN Imprint Name: City and State (If applicable)

“You can’t connect the dots looking forward; you can only connect them looking

backwards. So you have to trust that the dots will somehow connect in your

future. You have to trust in something – your gut, destiny, life, karma, whatever.

This approach has never let me down, and it has made all the difference in my

life.”

-Steve Jobs

“The reasonable man adapts himself to the world: the unreasonable one

persists in trying to adapt the world to himself. Therefore all progress depends

on the unreasonable man.”

-George Bernard Shaw “I knew that if I failed I wouldn’t regret that, but I

knew the one thing I might regret is not trying.”

-Jeff Bezos

“Whether you think you can, or think you can’t — you’re right.”

-Henry Ford

The 3G Way

Contents

Preface

Introduction: What Is—or Better, Who Are—the 3G?

Section 1: People

Chapter 1: Meritocracy

Chapter 2: Informality

Chapter 3: Candor

Chapter 4: Growth

Chapter 5: People Processes

Section 2: Dream

Chapter 6: A Big Dream

Chapter 7: The Importance of Gaps

Section 3: Culture

Chapter 8: Ownership Mentality

Chapter 9: Client Focus

Chapter 10: Leadership

Section 4: Operations

Chapter 11: Vicente Falconi and the Systematization of the 3G

Way

Chapter 12: Costs and Budgeting

Section 5: The top-down view

Chapter 13: Picking Industries

Chapter 14: What’s in for the future

A Five Forces model analysis for AB Inbev

A Five Forces model analysis for Heinz

Attachment 1: The Eighteen Commandments of the 3G

Attachment 2: The Eighteen Commandments of the 3G in original

(Portuguese) text

Bibliography

Preface

Before telling you what this book is, I am going to tell you what it is not.

It is not intended as a comprehensive management manual; it’s not

intended as a definitive guide; it’s not intended as a biographic account;

it’s not intended as cheesy, entertaining Business nonfiction; It is

intended as a no-frills introduction that I hope will give you some

management ideas to apply yourself, and inspire you to research the 3G

Way further. My intention is to provide you a door into the methods

applied by the trio.

In being true to 3G’s philosophy, I have kept the book as short and as

simple as possible. I am just trying to bring a little more color and detail

to the methods Jorge Paulo himself has repeatedly reduced to “hard

work and discipline.” For the sake of your time, and mine as well, I have

also avoided current trends in Business nonfiction such as telling stories

for every single point I wanted to make. Although it makes the read

more entertaining, it sounds manufactured and takes up precious reader

time, that should be spent in applying the content anyway.

I based myself on various public sources in writing this book. Videos

recorded for Stanford Graduate School of Business and Endeavor,

magazine articles from HSM, Fortune, Forbes, and other top-notch

business publications, books, and informal talks with a dozen or so

former employees of Banco Garantia, AB Inbev, Burger King and 3G

Capital. In doing so, I hoped to form a cohesive view of their method,

while keeping the text as objective as possible.

I received no help from the trio on my research. The most I got, from

Jorge Paulo himself, was a hint that I was on the right track1. This is

easily justifiable: i) I am a newbie author and ii) they have historically

shunned any publicity. Nonetheless, I think the management world

would greatly benefit from a more complete, and technical, account of

their practices.

Lastly, I write this from a position of great admiration for the success

these three Brazilians have achieved in Business. First, because I have

these three Brazilians have achieved in Business. First, because I have

worked on great companies and bad companies, and know firsthand the

challenges that management presents. It’s much harder to produce the

kind of stellar results they have than it seems. Second, I feel proud for

them being Brazilians, whose private sector has frequently thrived

despite serious macroeconomic headwinds, corruption, a bizarre tax

code and an even worse law framework.

So I hope you enjoy this.

Francisco S. Homem de Mello

Sao Paulo, July 15th, 2014

Introduction

What Is—or Better, Who Are—the 3G?

3G means os três do Garantia, or the three from Garantia. They are Jorge

Paulo Lemann, Marcel Herman Telles, and Alberto “Beto” Sicupira, who

I will also call the “trio.” They are businessmen from Brazil who started

their careers at Banco Garantia, a local investment bank, and went on to

form one of the world’s most successful business legacies. To better

understand the span of their influence, it is enough to say that they

currently control AB Inbev, Heinz, and Burger King (these last two

American icons via their private equity firm, 3G Investments). as well as

a number of companies in Brazil, such as Lojas Americanas and São

Carlos Participações.

What sets this legacy apart from other great corporate stories around the

globe is its management style, which is applied to every company the

trio lay hands on, and has produced consistent and impressive results

since the 1980’s with great scalability. This style, which I am calling “the

3G Way” in allusion to the equally influential “Toyota Way” (from which

they have copied their share of techniques). is a combination of different

management theories, cultures, and practices which executives, business

owners, and employees can use to the benefit of their companies.

A bit of history

Banco Garantia: a partnership from the tropics

Garantia was the first large venture undertaken by Jorge Paulo Lemann.

A Harvard economics undergraduate with a passion for tennis, (which

took him up to the Davis Cup,) Jorge acquired a small broker dealer

called Garantia in 1971, with financing partially provided by family

acquaintances. In 1976, after rebuffing an acquisition offer from JP

Morgan, the broker dealer was converted into a bank.

The model for Banco Garantia came from the American behemoth

Goldman, Sachs & Co., which was founded in the nineteenth century and

was the most successful financial partnership of the century. Goldman

was the most successful financial partnership of the century. Goldman

Sachs worked as a meritocratic partnership, which meant that the most

talented up-and-coming executives were invited to buy into the firm’s

capital. Senior partners provided financing.

Garantia admired Goldman Sachs so much that at one point, Jorge Paulo

arranged for one of his partners, Luis Cezar Fernandes—who would later

go on and found Banco Pactual (now known as BTG Pactual)—to attend

an “internship” at Goldman Sachs to learn its ways. Cezar, as he was

called, took an aide to help him understand English: the recently hired

Marcel Hermann Telles. Jorge Paulo’s resourcefulness in asking for the

internship, and his eagerness to copy successful models from the world’s

best, would become a trademark of the trio. Later they did the same

benchmarking with Wal-Mart and Anheuser-Busch.

The final member of the trio is Carlos Alberto “Beto” da Veiga Sicupira,

who joined Garantia just a year after Marcel, in 1973, having met Jorge

Paulo in a spearfishing getaway.

Lojas Americanas and Cervejaria Brahma: the first steps into the

“real economy”

In 1983, after a couple of smaller investments in publicly traded

companies like Lojas Brasileiras and Alpargatas, Garantia performed the

first hostile takeover of the Sao Paulo Stock Exchange, Bovespa,

acquiring Lojas Americanas for twenty million dollars.

This was before the advent of public corporations’ management

entrenched themselves with poison pills and golden parachutes2. The 3G

are great skeptics of the efficiency of publicly traded corporations

(companies that have diffuse shareholder ownership, and thus no clear

owner with controlling rights.) These companies are fertile ground for

the development of principal-agent conflicts of interest, when managers

(agents) fail to maximize shareholder (principal) value because in

practice, management becomes the controlling shareholder by means of

influencing the composition of the company’s board of directors.

Lojas Americanas’s poor financial and operational performance, due to

the lack of management accountability, plus the desire to apply a

management style that was working at Garantia on the old line sector of

Description:The 3G Way is an introduction to the management style developed by three Brazilian entrepreneurs who took over some of the main icons of American capitalism: Anheuser Busch, Heinz and Burger King.