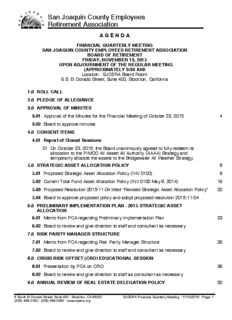

Table Of ContentSan Joaquin County Employees

Retirement Association

A G E N D A

FINANCIAL QUARTERLY MEETING

SAN JOAQUIN COUNTY EMPLOYEES RETIREMENT ASSOCIATION

BOARD OF RETIREMENT

FRIDAY, NOVEMBER 13, 2015

UPON ADJOURNMENT OF THE REGULAR MEETING

(APPROXIMATELY 9:30 AM)

Location: SJCERA Board Room

6 S. El Dorado Street, Suite 400, Stockton, California

1.0 ROLL CALL

2.0 PLEDGE OF ALLEGIANCE

3.0 APPROVAL OF MINUTES

3.01 Approval of the Minutes for the Financial Meeting of October 23, 2015 4

3.02 Board to approve minutes

4.0 CONSENT ITEMS

4.01 Report of Closed Sessions

01 On October 23, 2015, the Board unanimously agreed to fully redeem its

allocation to the PIMCO All Assett All Authority (AAAA) Strategy and

temporarily allocate the assets to the Bridgewater All Weather Strategy.

5.0 STRATEGIC ASSET ALLOCATION POLICY 8

5.01 Proposed Strategic Asset Allocation Policy (INV 0100) 9

5.02 Current Total Fund Asset Allocation Policy (INV 0100 May 9, 2014) 16

5.03 Proposed Resolution 2015-11-04 titled “Revised Strategic Asset Allocation Policy” 22

5.04 Board to approve proposed policy and adopt proposed resolution 2015-11-04

6.0 PRELIMINARY IMPLEMENTATION PLAN - 2015 STRATEGIC ASSET

ALLOCATION

6.01 Memo from PCA regarding Preliminary Implementation Plan 23

6.02 Board to review and give direction to staff and consultant as necessary

7.0 RISK PARITY MANAGER STRUCTURE

7.01 Memo from PCA regarding Risk Parity Manager Structure 26

7.02 Board to review and give direction to staff and consultant as necessary

8.0 CRISIS RISK OFFSET (CRO) EDUCATIONAL SESSION

8.01 Presentation by PCA on CRO 36

8.02 Board to review and give direction to staff as consultant as necessary

9.0 ANNUAL REVIEW OF REAL ESTATE DELEGATION POLICY 52

6 South El Dorado Street, Suite 400 • Stockton, CA 95202 SJCERA Financial Quarterly Meeting • 11/13/2015 • Page 1

(209) 468-2163 • (209) 468-0480 • www.sjcera.org

9.01 Real Estate Delegation Policy No. INV 0410 53

9.02 Recommendation: No Revisions

9.03 Board to discuss and give direction to staff as necessary

10.0 QUARTERLY REPORTS FROM INVESTMENT CONSULTANT FOR PERIOD

ENDING SEPTEMBER 30, 2015

10.01 PCA Quarterly Investment Performance Analysis 56

10.02 PCA Manager Compliance Report - 3rd Quarter 2015 104

10.03 Mr. David Sancewich, Consultant with Pension Consulting Alliance, will review

and discuss the reports in relation to the Board’s investment policies

10.04 Board to review and give direction to staff and consultant as necessary

11.0 REPORTS

11.01 Monthly Investment Performance Updates

01 PCA Investment Market Risk Metrics - November 2015 114

11.02 PCA Manager Due Diligence Meetings and Reports

01 Manager Due Diligence Schedule 132

02 PCA Memo on meeting with Mt. Lucas MLM Managed Futures Strategy - 133

November 2015

03 PCA Memo on meeting with Crestline Opportunity Fund II - November 2015 139

11.03 RV Kuhns Public Universe Analysis - June 30, 2015 144

11.04 CIO Report

01 Proposed Financial Agenda Topics 205

11.05 Report from Real Estate Committee

01 SJCERA Committee Chair and staff will provide a brief summary of the

outcome of the Real Estate Committee and investments

12.0 CORRESPONDENCE

12.01 Letters Received

01 October 2015 PCA ESG/ Sustainability 207

Institutional Investor Market Development

12.02 Letters Sent

12.03 Market Commentary/Newsletters/Articles

13.0 COMMENTS

13.01 Comments from the Board of Retirement

13.02 Comments from the Chief Executive Officer

13.03 Comments from the Public

14.0 CLOSED SESSION - CONSIDERATION OF INVESTMENT TRANSACTIONS,

PURCHASES, SALES; GOVERNMENT CODE SECTION 54956.81 (4)

SJCERA Financial Quarterly Meeting • 11/13/2015 • Page 2

15.0 CALENDAR

15.01 Regular Meeting, December 11, 2015 at 9:00 AM

15.02 Financial Meeting, December 11, 2015 upon Adjournment of Regular Meeting

16.0 ADJOURNMENT

SJCERA Financial Quarterly Meeting • 11/13/2015 • Page 3

San Joaquin County Employees

Retirement Association

M I N U T E S

FINANCIAL MEETING

SAN JOAQUIN COUNTY EMPLOYEES RETIREMENT ASSOCIATION

BOARD OF RETIREMENT

FRIDAY, OCTOBER 23, 2015

AT 9:04 AM

Location: SJCERA Board Room

6 S. El Dorado Street, Suite 400, Stockton, California

1.0 ROLL CALL

1.01 MEMBERS PRESENT: Shabbir Khan, J.C. Weydert, Michael Duffy, Michael

Restuccia (left at 10:45 a.m.), Adrian Van Houten, and Raymond McCray presiding

MEMBERS ABSENT: Katherine Miller, Dave Souza, Margo Praus

STAFF PRESENT: Chief Executive Officer Annette St. Urbain, Chief Investment

Officer Nancy Calkins, Retirement Financial Officer Lily Cherng, Information Systems

Manager Tallie Claypool, Department Information Systems Specialist II Jordan

Regevig and Office Assistant Andrea Ireland

OTHERS PRESENT: Deputy County Counsel Andrew Eshoo, David Sancewich,

John Linder and Ryan Lobdell of PCA

2.0 PLEDGE OF ALLEGIANCE

2.01 Led by Cindy Garman

3.0 APPROVAL OF MINUTES

3.01 Approval of the minutes for the Financial Meeting of September 25, 2015

3.02 Board unanimously approved the Minutes of the Financial Meeting of

September 25, 2015.

4.0 CONSENT ITEMS

4.01 Report of Closed Sessions

01 On October 24, 2014, the Real Estate Committee unanimously approved

Resolution 2014-10-03 titled "Principal US Property Account" and authorized the

Chair to sign the necessary documents to invest $20 million in the Fund.

4.02 Board approved the consent item.

5.0 INVESTMENT OPPORTUNITIES

5.01 CRESTLINE OPPORTUNITY FUND III

01 Presentation by Managing Directors Sean Gannon and Keith Williams of Crestline

Associates, L.P.

5.02 WHITE OAK SUMMIT FUND

01 Presentation by Barbara McKee, Founder and Managing Partner and Milbrey

“Casey” Jones, Managing Director,of White Oak Global Advisors

5.03 PCA Book on Direct Lending Manager Search

6 South El Dorado Street, Suite 400 • Stockton, CA 95202 SJCERA Financial Meeting • 10/23/2015 • Page 1

(209) 468-2163 • (209) 468-0480 • www.sjcera.org

5.04 Subject to legal review and successful negotiation of terms, the Board

unanimously approved a contingent commitment of $50 million to each

opportunity: Crestline Opportunity Fund III and White Oak Summit Fund.

(Mr. Restuccia left the meeting at 10:45 a.m. prior to the Board’s action on this item.)

6.0 2015 ASSET-LIABILITY STUDY

6.01 2015 Asset-Liability Study Results - Strategic Allocation Decision

6.02 Presentation by David Sancewich, John Linder and Ryan Lobdell of PCA

6.03 Motion by Weydert, second by Restuccia, carried to adopt the long term

strategic asset allocation policy for SJCERA, identified as “Option 1” on page 8

of agenda item 6.01, with Garman and McCray voting no. The asset allocation

percentages are: 30% global public equity, 10% stable fixed income 14% credit,

14% risk parity, 12% private appreciation, and 20% crisis risk offset.

7.0 BOARD EVALUATION OF CONSULTANTS

7.01 Consulting Actuary - Board Evaluation Summary

7.02 General Investment Consultant - Board Evaluation Summary

7.03 Real Estate Investment Consultant - Board Evaluation Summary

7.04 The Board briefly discussed each of the evaluation summaries. Trustee Weydert

asked if PCA would provide input on SJCERA’s real estate portfolio (this is not

currently included in the scope of services in SJCERA’s contract with PCA.) This was

an informational item; the Board took no action nor gave direction on this item.

8.0 REPORTS

8.01 Monthly Investment Performance Updates

01 Manager Performance Flash Report (provided at the meeting)

02 PCA Investment Market Risk Metrics October 2015

8.02 PCA Manager Due Diligence Meetings and Reports

01 Manager Due Diligence Schedule

02 PCA Memo on meeting with Parametric regarding Policy Implementation Overlay

Service (PIOS) - October 2015

03 PCA Memo on meeting with Parametric regarding Contraction Strategy - October

2015

8.03 CIO Report

01 Proposed Financial Agenda Topics

02 Trustee Weydert referred to Research Affiliates’ October Newsletter, agenda item

9.03-01, stating that it was very interesting and enlightening. He encouraged the

Board to read it if they had not already done so.

8.04 Trustee and Executive Staff Travel

01 Conferences and Events Summary for 2015-2016

a 2015 Opal Financial Group Alternative Investing Summit

b 2016 Public Funds Roundtable

SJCERA Financial Meeting • 10/23/2015 • Page 2

02 Summary of Pending Trustee and Executive Staff Travel

03 Summary of Completed Trustee and Executive Staff Travel and Travel Report (1)

a 2015 CALAPRS Administrators’ Institute

8.05 Report from Real Estate Committee

01 CIO Calkins provided a brief summary of the outcome of the Real Estate

Committee meeting and investments

8.06 Board accepted and filed reports.

9.0 CORRESPONDENCE

9.01 Letters Received

9.02 Letters Sent

9.03 Market Commentary/Newsletters

01 Research Affiliates Fundamentals October 2015

10.0 COMMENTS

10.01 Comments from the Board of Retirement

10.02 Comments from the Chief Executive Officer

01 SJCERA Remedial Cycle E Filing with IRS - Received word from tax counsel

Hanson Bridgett that SJCERA’s filing was submitted to the IRS on October 21st.

02 SIS and Verus Merger Announced - SIS and Verus Advisory, Inc., formerly

known as Wurtz & Associates, are merging, under the Verus name; reported as

synergistic for both firms; no layoffs or departures are expected.

03 SACRS Membership Survey Online - Reminder that responses are due October

30th.

04 Cyber Liability Insurance - Coverages offered through the CSAC Program

written by unadmitted Lloyds of London does not to be as comprehensive as other

product offerings. Staff will work with Trustee Duffy on next steps for the Board’s

consideration.

05 Thank You to RPESJC - Ms. Urbain thanked RPESJC for inviting her and Mr.

McCray to present a “fireside chat” this past Monday afternoon at the CRCEA Fall

conference held at the Stockton Hilton. The topic was the role of a public pension

trustee. Ms. St. Urbain noted that It was a pleasure to be a part of the conference

program, and it seemed the session was well received by the participants.

06 Asst. CEO Update - There have been some complications with the family health

issue; It is uncertain when Ms. Pabst will be returning to the office.

07 SACRS Travel Packets - Are provided the Board dais for those of you who are

attending the Fall Conference.

10.03 Comments from the Public - None

11.0 CLOSED SESSION - CONSIDERATION OF INVESTMENT TRANSACTIONS,

PURCHASES, SALES; GOVERNMENT CODE SECTION 54956.81 (1)

SJCERA Financial Meeting • 10/23/2015 • Page 3

11.01 The Chair convened a Closed Session at 11:36 a.m. The Chair adjourned the Closed

Session and reconvened the Open Session at 11:42 a.m.

Counsel noted there was nothing to report from closed session regarding this subject.

12.0 CALENDAR

12.01 Regular Meeting, November 13, 2015 at 9:00 AM

12.02 Financial Meeting, November 13, 2015 directly following Regular Meeting

13.0 ADJOURNMENT

13.01 There being no further business the meeting was adjourned at 11:42 a.m.

Respectfully Submitted:

________________________

Raymond McCray, Chair

Attest:

________________________

Michael Restuccia, Secretary

SJCERA Financial Meeting • 10/23/2015 • Page 4

Board of Retirement Financial Meeting

San Joaquin County Employees’ Retirement Association

Agenda Item 5.0

November 13, 2015

SUBJECT: Revised Strategic Asset Allocation Policy

SUBMITTED FOR: __ CONSENT l_X_ ACTION ___ INFORMATION

RECOMMENDATION

Staff and consultant recommend that the Board approve the proposed Strategic Asset

Allocation Policy (INV 0100), and adopt proposed Resolution 2015-11-04.

PURPOSE

To incorporate the long-term strategic asset allocation the Board selected for the SJCERA

portfolio in October 2015, and make related revisions to the policy as recommended by

Pension Consulting Alliance and staff.

DISCUSSION

The proposed revisions to the current Total Fund Asset Allocation Policy (INV-0100) retitle

and recast the policy to respective allocations and benchmarks. These have been discussed

with the Board throughout the conduct of the 2015 Asset-Liability Study for SJCERA,

culminating in the Board’s selection of a revised strategic asset allocation for the portfolio at

its October 23, 2015 Financial Meeting.

The proposed revisions also identify some general investment beliefs derived from the

Board’s discussion, key decision factors and selected asset allocation, and clarify and refine

the general guidelines for portfolio rebalancing.

ATTACHMENTS

Proposed Revised Strategic Asset Allocation Policy (INV 0100)

Current Total Fund Asset Allocation Policy (INV 0100) – May 2014

Proposed Resolution 2015-11-04 titled Revised Strategic Asset Allocation Policy

__________________________

ANNETTE ST. URBAIN

Chief Executive Officer

San Joaquin County Employees'

Retirement Association

Creation Date: October 2007 Created By: Nancy Calkins

Updated: November 13, 2015 Updated By: Pension Consulting Alliance

Policy Number: INV 0100 Revision: 7

STRATEGIC ASSET ALLOCATION POLICY

PURPOSE

This Policy outlines the goals and investment objectives for the San Joaquin County

Employees’ Retirement Association (SJCERA), provides general guidelines for managing the

investments of SJCERA, and defines certain specific provisions that will govern how the goals

and objectives are to be achieved.

The SJCERA board believes that the investment policies described in this Statement should be

dynamic. These policies will be reviewed and revised periodically to ensure they adequately

reflect changes related to SJCERA and the capital markets.

This policy supersedes any prior Board adopted policies related to asset allocation.

INVESTMENT BELIEEFS

A. General

1. We believe that risk for SJCERA is the inability to meet benefit obligations when due.

2. We believe that the paramount duty of the SJCERA Board is to manage the assets

of the Plan in a prudent manner.

3. We believe that SJCERA should monitor current and future benefit obligations to

ensure long-term solvency of the Plan.

B. Investment Strategy

4. We believe that SJCERA should invest its assets and manage its liabilities so as to

increase the likelihood of paying all benefit obligations over time.

5. We believe that SJCERA should seek a long-term rate of return that exceeds

inflation, while recognizing and managing the need to maintain adequate liquidity to

pay benefits.

6. We believe that SJCERA should invest globally, seeking investment opportunities in

a variety of asset classes and management styles, in order to improve the likelihood

of being able to meet benefit obligations over time.

C. Pattern of Investment Returns

7. We believe the volatility of investment returns is as important as the level of returns

in determining SJCERA’s ability to meet future benefit obligations.

8. We believe we should be able to reduce the volatility of the SJCERA portfolio returns

and the risk of large portfolio drawdowns through diversification, opportunistic

allocations, and passive investing where appropriate.

9. Therefore we believe that actions to manage volatility should be appropriately

integrated into the investment decision-making process.

INVESTMENT OBJECTIVE

The funding obligations of SJCERA are long-term in nature; consequently the investment of

portfolio assets should have a long-term focus. The assets shall be invested in accordance

with sound investment practices that emphasize long-term investment fundamentals. The

investment objective for SJCERA assets is to achieve long-term investment returns that allow

the plan to meet all benefit payments to plan participants. It is expected that this objective can

be obtained through a well-diversified portfolio structure in a manner consistent with this Policy.

Accordingly, the investment of these assets shall be guided by the following underlying

principles:

• To achieve a positive rate of return over the long-term that significantly contributes to

meeting SJCERA’s objectives, including achieving the actuarial assumption for rate of

return and satisfying expected benefit payment obligations;

• To provide for asset growth at a rate in excess of the rate of inflation and of the liability

growth rate of SJCERA;

• To earn a sufficient rate of return while minimizing exposure to losses or wide swings in

market value.

SJCERA POLICY INV 0100 PAGE 2 of 7

Description:01 Conferences and Events Summary for 2015-2016 a 2015 Opal Financial 07 SACRS Travel Packets - Are provided the Board dais for those of you who are attending the Fall .. Public Market REITs. 2.5% .. Correlation. S&P 500. Down Mkt. Capture. S&P 500. Up Mkt. Capture. AQR. 5.7. 0.6. 0.2.