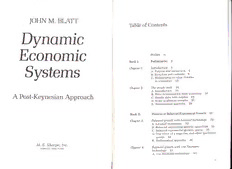

Table Of ContentI

M. BLATT

IOHN

Table of Contents

Dynomic

Economic

Preface ix

Book I. Preliminaries 3

Systems Chapter 1. Introduction 4

A. Purpose and limitations 4

B. Structure and contents 8

C. RelationshiP to other theories

in economics 12

Chapter 2. The steadY state 16

A. Introduction 16

A B. Price determination from quantities 18

Post-Keynesian Approach

C. Steady state with surPlus 22

D. Some qualitative remarks 25

E. Mathematical aPPendix 28

{

Book II. Theories of Balanced Exponential Growth 30

,[l

ilr Chapter 3. Balanced growth with Leontief technology 32

A. Leontief technologY 32

l' B. Balanced exponential gtowth: quantities 35

I C. Balanced exponential growth: prices 39

D. The effect of a wage rise, and other qualitative

points 42

E. Mathematical aPPendix 46

M. E. Shorpe, Inc.

Chapter 4. Balanced growth with uon Neumann

ARMONK, NEW YORK

technologY 53

A. von Neumann technologY 53

I

('()N',I'/,;N',1'S rtii

ll. (lonrlitiorrs

growth b9lirr llalanccr.l cxponential Chapter 9. Schematic trade cycle models: parpt rIi nc7ip67le

C. The growth theory of von Neumann 61 AB.. TInhtero adcuccetiloenra: tothr-em aucltcipellieerra tmiono del 170 767

D. The growth theory of Kemeny,-Morgurrtu.r, C. The inventory cycle 776

and Thompson (perfect thriftj'

OS D. Mathematical appendix 183

!. lome qualitative points 66

F. Mathematical appendix 67 Chapter 10. Schematic trade cycle models: part II 189

Chapter A. The Hicks model 189

S. The open Leontief model

A. cCoonnsduitmiopntiso n7 ulnder steady7_0s621s BC.. TThhee FGroisocdhw min omdoedl e19l 8204

B. Discretionary consumption goods and D. Mathematical appendix 211

peculiar solutions

C. Peculiar solutions, or7 6none g0 Chapter 11. Econometric models of cyclical behauior 217

DE.. MThaeth Leemoantticieafl ianppupte_onudtipxu tg 7model g4 AB.. TEhceo nnoemede tfroicr mmooddeellss 222107

C. Inconsistency of the econometric

Chapter 6. BAlr..o TFyhotehrm sutimhlaepotlieorysn t wocifat hgs reco ow9ni2lsr uilmrcportiyo n f)l DE.. AaMnna atahlyletesmrisnaa ti2cti2av4el aapnpaelynsdisix 222373

wi{,h

consumption g6

C. Consumption within ilrc KM,l,ilrr.or.y

D. Results and discussron 100 l)1) Book IV. Economics of Uncertainty

E. Mathematical appcn<lix

101-r Chapter 12. The utility of being hanged on the gallows 245

Chapter Z. DAy. nInatmroicd sutcatiboinlit y t I1 AB.. RExispke catnedd uunticlietyr tathinetoyr Y24 5248

111

B. Dynamic instability-Loorr C. Criticism of expected utility theory:

technology Jl4 ti0t. a first look 257

C. Input substitution D. Criticism of expected utility theory: the

I). Discussion 119 gallows 253

130

f,l. Mathematical appendix E. Avoiding irrationality 257

l:17 F. Criticism of expected utility theory: summary

and conclusions 263

llrrrl ll I 'l'lrr.orir.s ol' l,he Trade Cycle G. Mathematical appendix 269

1,17

hu1'1r,1 ;1 I trtttl t.\,t.lc.s Chapter 13. Inuestment eualuation under uncertainty 275

.\ I 4g A. Introduction 275

ll ll,,rrrrrr,rrrrrl., .rl;,yrs.ll,rr,.rrr;r s l:lrrrzrrl t,lrt,ir lirrril,;rl,iorrs l,t:) B. Some basic concepts 279

I C. Types of uncertainty: the survival

:I' I\\ lr,;rl,t.tl ,rr,r1r,r.'rt,rr.ru,,rlrr,rr, rlt.ln irrl.trl nt r lrvn.rrjtt.:rlrutrl,rrtr.trirrly. 1(l,,rr(t.l.t(ri)cllrtr(.r),t. ,ytlr((..irljcil lI( ;!tl'l D. Tprihrsoek bp aayb-iblaitcyk 2ti8m2e in relation to the downside

285

ru

l,). 'l'hc lrorizon of unccrtainty 2g6

I,'. Mathcmatical appendix

Zgz

Book V. Deferred Topics 900

Chapter 14. Notes on the nineteenth-century trade

cycle

3O2

A. Introduction gO2

Preface

B. Long-run predictions of Ricardo

BO4

C. The trade cycle as a transfer device A06

D. Implications for trade cycle theory 810

Chapter 15. Notes on the Tableau Economique Bi,b

A. Background and importance g1b

B. Quantities 877

C. Metayers and fermiers g1g

D. Prices 322 The aim of this book is explained and a brief description of its or-

E. Marginal utility and welfare 824 ganization appears in the introductory chapter. The purpose of

F. Mathematical appendix ihis preface is to express my thanks and appreciation to the people

B2g

and the organizations who have been so helpful to me in writing

Chapter 16. The quicksand foundations this work.

of econometrics 3Bb My first thanks go to those who have been kind enough to read

A. Introduction all, or nearly all, of the manuscript in various draft stages and who

Bgb

B. A textbook example gBz have contributed extremely valuable comments and criticisms:

C. Specification errors Professor Alfred Eichner of Rutgers University, Professor Peter

D. Discussion 844 B4O Groenewegen of sydney university, Professor Geoffrey Harcourt

of Adelaide university, Professor Murray Kemp of the university

Bibliography gb1 of New South Wales, Dr. Ulrich Kohli of Sydney University, Dr'

Index Helen Lapsley of the University of New South Wales, and Mr'

388

About the Author ggz Brian Martin of the Australian National university. It is impossible

to exaggerate the importance of their contribution, or my debt to

them singly and collectivelY.

I am also greatly indebted to many others who have given me

vaiuable advice on particular areas, including Professor Malcolm

Fisher, Dr. Flora Gill, Professor Jules Ginswick, Dr. Josef Halevy,

Dr. Peter Jonson, and Dr. Robin Pope.

It should not be thought that all, or even most, of them are

in agreement with the views put forward here. These views have

developed and their literary expression has been improved through

continued interaction with kind people willing to give of their

time and expertise in order to aid a man come to the field but re-

cently. This has been equally helpful, and equally appreciated by

me, whether it has come from a person generally in agreerhent, or

strongly in disagreement, with my own views. Naturally, I take full

responsibility for the contents of this book, including all its shorb-

E-_'

I

i

(:()r)lings. '['lrcsc rcfltxrt on me only, not in any way on the many

kind ptrlpkr to whom I owe.o -r"h gratitude.

'rhe writi,g was greary herped by a study reave of five months

as a guest of the schoor of Economics at Sydney university. I

thank the University of New south wales ror granting me trris

lgur", ul9 Sydney University for making -y ,iuy tt ru"n

u

thoroughly enjoyable, exciting, and stimulating experienc"ei".-

Another area of indebtedness of any author is to the literature

in his field. I am not, alas, an avid rea-der. As a result, I must now

apologize to those schorars whose books and articles'shourd have Dynomic

been, but have not been, cited. In all these cases, it may be taken

for granted that the omission is due to my not having read the Economic

wolk i.n question, not to any deliberate decision o" .iV p*t to

omit citation of the work. other omissions are associated with the Systems

very considerable delays before overseas books get into Ausiratian

vuineiwve arsrtiitcyl elisb raanrdie sb.o poaksrt iwalh aicmhe cnodsn taarien mfuandeer, lIis tilso pLef ,'s ncVf, o"uiirii"yg rer"r_-

erences.

Mrs. Jill Pollock has been enormously helpful, particularly in

connection with the list of references.

Last but not least, I owe profound gratitude to my wife, Ruth,

for her love, good nature, and continuei forbeara"".a"ri"g

u., u*-

tended, and no doubt difficult, period with an author in the throes

of writing.

John Blatt

Sydncy

-

BOOK I

Preliminories

Chapter 1 is an overall introduction to the book' explaining its

;;d;;;, it, lirrritutions, its structure, its organization' and its rela-

iiorrtfrip'to other work in theoretical economics'

Chaiter 2 is a preparatory study of pure steady-state input-

output systems, Uottr ior the case of bare subsistence and for the

case of a social surplus. To get a steady state in -the latter case'

or"^rrtassumethatthe.rtpt,rtisnotinvestedforgtowth,but

rather that aII of it is consumed. The purpose of this chapter is

twofold: (1) to show, following Sraffa (1960), that.the neoclassi-

cal mechanism of supply and demand for determining prices can

f" Uyp^r"a in favor of u -o"ft simpler procedure' and (2) to show

;;;"St"ff"'s procedure must be modified when we turn to dynam-

ic Jconomi"r, i."., when steady-state conditions are no longer true

for the system under study.

Ciln t,'t'til{

I Sur:h argumcnts did carry a great deal of conviction two hun-

drcd years ago, when the basic ideas of the science of economics

wcre being formulated for the first time.

However, it is impossible to ignore the passage of two hundred

years. A baby is expected to first crawl, then walk, before running.

But what if a grown-up man is still crawling? At present, the state

Introduction of our dynamic economics is more akin to a crawl than to a walk,

to say nothing of a run. Indeed, some may think that capitalism as

a social system may disappear before its dynamics are understood

by economists.

It is possible, of course, that this deplorable lack of progress is

due entirely to the technical difficulty of investigating dynamic

systems and that economists, by following up the present lines of

A. Purpose and limitations research, will eventually, in the long long long run, develop a use-

ful dynamic theory of their subject.

tThhee c beincteenntaernya royf 7th! er n.,e"o w"teuartrthi" Jol"f' rNJ.a,ttiioon.s, has passed, and so has meHanosw etrvueer, tahnaot tah/e/ rd pynoasmsibici libtye hmavuisotr ncaont bbee iugnndoerersdt.o oItd isb ebsyt, noor

present state of dynatmo,icr ,e"*co initoimi"i,cr eth,e ory reinav eesc ovneorym mi"ru. cvh "tto t rbre" eitsve enq uunildiberrisutmoo ds taatte a. lCl, obnys idsetarr bthineg wfraovmes aa nsdtu tdidye os fo tfh teh es yssetae.m T hine

,T:il:i;r;;.fl;;* o f significanii.pil,"_unt equilibrium state is a tideless, waveless, perfectly flat ocean sur-

fino rFtte roromnm st h toheef s attiunmd aevr moooff seAt dquanumivi elSirbsmaiirit h;c;,o ;efnfccio.inn otrmaitcio tnh eoofr yth hoausg dhet vaenlodp eefd- efcasecsneet.nr acTethe oi sof intsh netho pe hh eeenlqpou amilti ebanrllio uinnm ws tseut adaytreein. tgrE ywxinaagvce ttslyo a tnshdtue td idsyea swm. heWe ines lwotrseue ec to hnoe-f

of static equ,ibrium,'". rtrt"r"Ji"r"oTohoerstei omnaavr be either srates meteorology, the study of the weather. Everythingthat matters and

growth. Trury dvnamil prr"ro."rrr, and baranced is of interest to us happ ens because the system is not in equilibrium.

ofwrricr, trr" moJ.titi,g In the first example, the equilibrium state is at least stable, in

ffiij; is the trade cycte, have U""i p"rr,"a t. tr,"-Ja"iir", "rr"_- the sense that the system tends to approach equilibrium in the ab-

tporrfu o11Iepn' a o dSd:ry tetadinfoteyainncnmaassem li oc gio crrfs o (,wt whtthihhsea rcites o cnamorcmeue ceniwhstr a"tu t.i"u orrn-*ir" _"ro-r"tnro"' ,e "thh,qauen, idbslraeimu tmeh e thaonirnedgt it)ch aebl alvnra e"ntgrhcl ae.rrcrrt soateoengq ndyuec .i qveliTabu ohrriliiefioub umdrinsiius. p mtouTutr.hht b eeNoa rofn t rerceu,fe nfefeseo .cre rgtB qsyt huu kfaitler itobte hmmrpei uar temththt ee ies rs ,s t snyawuostneot e,,su mutilhndc ehf rwt ohrsemeot a tw aabgibtsieislhoitett nyinint c gioetno f a o mtathf paeehplt eleer aocoatlaorr otcisnhhle--,

llsttl'w,nulirturbeearai.sncr2attlei keesu.tf s el tmIbisautsdnacenp, , rt fd ayouasta rasonhtenpo yt e drict woewo cornddaae me eosrs qRdceppvwua ,ehai ian*nsawreht. aiktli ahooe,t.b.itri. vmrtlu t"eregfhrltog m r envtrrtnh p" rtatreo h-t .e "ri ete-",A"f"v ; eos r; e,*tt;gr*fuur";efo_,ar;;irnon;r'y.i; i d c ;re?o- ;b u;f";s. ;;naidi;y;r"d""yisttt renitu"oeaaartsm b"tmnt r*oa i.sp"ciu nsr s.Ntd i . ces iwanevTwmrgehsh.er ,uiac, c oa",imhn ift'ca r ,u<s<.lsnnusJt<tlruatv.tir ,,<ti tr ,,ri.r:i.,cwvtl.ar slrr,rtr'ihrr 'iun,lri,i rrn:,s rrr,litg,r ,r_<,ar pNTpceainlhuqnuoo euTttdnuth ih defliehiirsenbs o e or,strmv aeeieufeetr n meetrtstichhnsyex..te pii,itsssn hutf stgeoact u kaatrnf fn drn,tee ohoy iasvemb,w t eayueb rnt r yt ueau hatsrt shnete y eidt nsohmnsetgefueor p s mnttte rhth ejosriuesaaso,s uttdtsttu hhl y mtrseiesbenmart gyeekbwam f eaolwhclss reo epieacornae,et u ecptr hiet raonu" enleww rlr tbwsr leeiaaisfhsraette iiitcns onnhcohgnoteoiu sartmtr .o lh clsaeynTeetsr e h o adafietumo yod snrnyh pt da uaewo a dmassirntttyto oa ida mcipnsnol, le,".-t!f

rlir.r'l'lv, occurs, and these naturat prices ca, rl<,rrr.r,r.rrrrirrr,<r equilibrium state, perturbations which can be understood by start-

s l, ric I. r.t 1 r r 'i yI i I rirgiunmor ionbgt athinee dfl utfcrrtou"agtirio."u.}tlJ' ""g"ther arr<r w.rki.g;rs ir. innagm ficros mas aan s atuftdeyrt hoof utghhet .equilibrium state and tacking on the dy-

I

8""

oTrskoufhi anretIpdid mfrs ,it iteshtuti h nadsaegythn n. doe o Nuc,fero lodefenf oc opbloramretno.c iogstkrmrt useoi escfhs' aptechvraqoaeng ut b ratleehi sbecesnorn i im unfbo'prdellrey ,omt niwttaarivricmn"el.eg ,i c mUrf io"Vta"rr reoc kto rewmrnto otosi*n yrirue"sr,i t"r te"rhimgE,a n*naisa fooa o rtywrofge ar tahtgsrttsa "e".,t v[tmLiraoioaalnunt h esruge sisam,ne ta: achtnlt.w6i dcdI ons o rtfauih ntnaeh k gumnmnro aaiwgvttrehanirexrsslm yiitin isaeiv ntsteich ;r haseteli ghm aheapo r pessme ctnt ehhddaoeiicnfq femilin;sc ,gaus iotnlothl vferm ie nalqaeg utvm hteiwreale moitmsr aielxsitnen,ic cetoasoal.nf r d owee pihyqgeeeeurannaa----r

ever more advanced mathematics is required-and this is very

smtaaTrinth idspe uivsrep tlohospeei n bigas s ttihco e c potroneotseresnn ttwi ouhnrf gtohrf -Dauryient .an mefoeicrd etEhdc istoo nc omomnatikceesny tpisorfoengm raesns.d s Ititnos rbmauartet hwlyei mtihna dtriecefsee rsdehn-otchuelsed teroen lasebuvliaetan bat lletl h eteecoxortnebomomosik csas.r esT tshutidsae tvenedtsr y,w asintphdao rminugat npuyrs oelao oyf-,f

iwunnig.t dAh ed. rysistnut,aa binmssd iditicnoi ag erp ycrt orepunsuoleyrmpn odti.csya en tc,ah rmeriteoiicrcraai teree scds-o u-ntirnoore" mptyhia-ceor tfsi mcytrusartr"iean mr rno,s on."e" birunt pnootJ i*dte netxicisat-l mffooelrln og,w rtao nt htreeed a,md b aauthnted im fu anthtdiceearysl taaarnpedp eptnrhedipisca ebrseo dom ktuo fs utd lltoya .kt heTa httoh, sete h mewayht howe cmilala nltonicsoset

eaTarnnhad2ciLtsu 'e.i rtsdIIe ttu c. praeivsrnseot aybup besosr eeirustrfshiyuoeeelnd ssi a ntacrh s oi rtsgnlseurt coa ophcwwu tb trnhpby oe r issatgwelnuhsedd:tee, ntnah tsest h aeto hs fn eueemocwormi neaaosprm'yp.t hifrc ooes;fa .h tchp;her-e o#asrnei"edn st thov"iefye w"brtais"tr-,.- nhtsmieoeeaatTlfhptr ihciic,snh iss wgei nr hfdscroeo oofmne mrt srhuu e esnswct eo tmhd.tk a anTmptioon reiow sammp ncreea aotsrkhtlsmheyaae .gmt r reTe mo.mahnalio sltyphr e rueot,mna gafuaronegtridscht ussts n oitniaoms t deuesynlwtyunih mdaaaemptl nlo idcttrsoib f ofeaoe cnfrco teo ennomcotrom, m nomioocf msanli,t t ihbctrleesee--.-

tewchnuhinTtr3iicrgfh'ehi sceIn t a wtpt-rlhiryehsoi rignnbcderohl eocpt s ecwoisskni eseni sa adtt r chny ncb ioenotyeotrk dd t -bsah*ce ner-sel"co iea etmhgrf siwent# h wgiet eshrh a pi*ct*bat"Lhrote r hrJ aaif ot-artienoo cn nt" vso.fte .u t Trrkythhn eceo ormw ma.a dmiRnvo aacnntnhlc(y.e)r m,,h wyeit lh .difis,c hbsthc uii.-st Bmcmnaarouaacnkattt iibncwnbeeageh l e pfifbolhnuearr r eacebmiskahgegasendrtyrh o lpeiuafnormnno gdrtgae u.rt sraeiTmcogsshmses i, ,sei ust bohrn enuhedletiie a g prrnthsarocotltayeh gnw erdeodrhes anohssb nm iilrsteoah nbnamtlmooeta r ,ahm tphtapehaesroeo lmp ambmllaeraaeto bitwcadiclsdyeiat y hlieo sobdsf u seincteteho tnniimotnt inmakas olita,nhh mdtgeaoees-;

I iotttsnhionvova ee!eb t Ps rageitrsneiocg gtigosnair nncetnegoosod smnnp !se cirecoYcan gtnsme rei edtbo., seed 1sai e n rssrte oso at ta, nh marmdidnsu eom saddatibse sUlnrs esieJyan l wdra ,tit snia"tt oagh-nn c t"mauteo tn outra,sf" cbt t"ahfhopab euwctclrrettlehs. s . eeie c,isB,qq,hE uuuw nvuitioelrr t.,witrr"rihryl rlhioio,irni .;ln,r. ;g,.rc;itrl ,r.r i"auv(kt;, rsin, tr,r.y.o:r (,fy w,rr(v..,uirrrs,(sr...,,(s.rr-,,t ocmwlwitonheiomlAtirychnan tpb,rtto -ieupm ottrahoieretreli L.vy lr" ae, Tus lctnoihrmck eliotis sg"ion tsuooadef mp tdtiitsooo,ii oys lnqwymsnu ,isho opi atnrfaeeit n tt sihehsr tiyxmi rgsni tce hfoowotntistolr toty t,n rot ,chsk ta hie nbsie osee e snt tcfhi.hfn oeoTeetn erhn sttrr eeotephrnr-sryaceetts,ai r ot iileboslcneed trsdine o anroopnes o fs ld adtsutoiittschs-e ccKaacdeugelt sas rymssessnfisecuaoeihmltcns.toae ieaolornlnsyl.ft

okvneorwtusm" ehda ptop ecnres atro t hbee psaimthp ltyo *r..,arnl g;r.., r.gi,.,r,.rr,t.,, ii,rrr. ,<,rr.y.rr,rri:r1rr,r irir.k .rlr,.r.r. ,r.rrrrrrsirl,. rl{r.. Rgeantht etor,w thaerd p tohset- Kneeyoncelassiasnicsa lh daovec tbrieneen. eTnhteir ealsys tuomop ktiionnd oafn de qinudiluibl--

crleto'lhttov'tfr0tl seiiTelt lnlrhrcc,. rioircorlsaecnsn sl o,itlsosirirml alr'ysar ir' lcor y,lbsil t,,rrao. or. y i oaIll,britkl no, wro i. isoirrrr. :rnn,rkncr:rr rryo. brlrrt, trarrrs rrcsi;c trti,irrl mrcrr,.rrrl lxrri,i,r,it.trot,<ri., lr,in>r,lcrrr.sr,rirrrr<,t r,rirrrir. ,r,l'il;rr.tr r, rr.,rl,.,,". ilvixr,r.ir,,clrr uJ,prrrl rr ,g,irl ro,,irrncrrr1rrr.<rr.rr,r crl.,rrrrrrlu,vr,rylrrrrr, .rirr rsl,.lt,,.it rrrr r<rr,wosl rlr< ,rl,,r, li ,'rrr,,rrk,r, .,lrs, rr,r,s ..,,rrc,rrr,rrr,,rr.r,,lvrrr r,,rrl,lr ,rr,,,rro.r, a,il ,,,.l,l:rrrrl.,r.,:iy rr r,r.,r,' ,r,, r1rk. rrr ,,rl,r,,Hrr,,(t1grrl)rrrl,,r,r,rrrl ioKbkthihuaenaeosmtlyvey unecs ge lilhenehistaa s eirsasrean inonilt nfhm g adceo,pee rrnc pi et oegriadqoerfs t pnubsatereehuiirnaem eahtntlmyep a t atsei oaot (rtfb mnna cetsocshe ekf.e(n neep Tt d.fugehtu hr.er(t,yfuR a e pmratocee gobct)r or oficeenw.ne csWvhprtote ireacncon hioLamnt igm9otairyn7nerp eee4aoe nl,i ftwn ti f tevtoiihptocahreaon l ie nrc,tf thxo upaioimnsetmfu r iocfcrtpeheru liecet!rtih)t ) c , tpe miimmsobomasarueyrty,-,t-

but that is not the point we wish to make in this book'

Rather, euen under its own assumptions, conuentional theory is

incorrect. A competitive economic system with market clearing

and certainty of the future does nof behave in the way that theory

claims it should behave. rt is not true that, under these assump- I,lach book contains a number of chapters, which are sequentially

tions, the equilibrium state is stable and a natural center of attrac_ numbored from 1 to 16. For example, Book II contains chapters

tion to which the system tends to return of its own accord. ob- S, i, 5,6, and 7. Each chapter contains sections which are labeled

viously, in any such discussion, questions of oligopoly, imperfect by letters, from section A onward' In many, though not in all'

market clearing, etc. are irrelevant. It is for thaireason, and onry [ne final section is a "mathematica] appendix'"

for that reason, that such matters are ignored here. "f,uBpot"orrk,' I, called Preliminaries, contains chapters 1 and 2-' which

In this view, the rise of origopoly toward the end of the nine- are the introduction and a study of the steady state' respe-ctively'

teenth century was not just an accident or an aberration of the ifr" prrpore of studying the steady state is primarily to call atten-

system. Rather, it was a natural and necessary development, to be tion to the advantui", Lt using concepts akin to those of sraffa

expected on basic economic grounds. John D. Roctefeller con- (1960), rather than-neoclassical supply and demand analysis' to

cealed his views on- competition and paid lip senrice to prevailing L"gi., tt study of economic dynamics' We say concepts "akin"

ideas when it suited him. But he was a genius, who understood the to-those "o f Sraffa, since the sraffa analysis itself is tied too closely

system very well indeed and proved his understanding through to the steady state to be direcUy usable in dynamic economics'

phenomenal practical success. Arfred Marshan,s principis of Eco- ButthefoundationslaidbySraffa,unlikethoselaidbySamuelson

nomics was written and refined at the same time that Rockefeller (.LBgo4o7k),l litsudme vooutte tdot obeth eexotrreiemseolyfb farulaitnfucel'dgrowth.Therearesev-

established the standard oil trust and piloted it to an absolute

dominance of the oil industry. There can be litile doubt who had eral dimensions to this survey, since growth theories can be distin-

theI tb feottlleorw usn dthearstt athned inthge oorfy t hoef tthruise bdoyonka mshicosu lodf nthoet sbyes atepmp.l2ied di- gui1sh. eDdi fifne rseenvet rtahl ewoaryies:s assume different technological bases for

raelecntlyt itno tchoen dtwitioennsti eothf mceonntouproy.ly H oorw oelvigeor,p othlye, twhheiochry u rrsl d,oir eprc"tuly_ the2 e. cMoannoym Yih.eories assume "petfect thrift"; others allow for con-

relevant to something equally prevarent, namery the creation of eco- sumption.

nomic myths and fairy tares, to the effect tnat att our prcsent-day 3.Thebalancedstateitselfcanbeanalyzedor'altematively'it

ills, such as unemployment and inflation, a.re due prirnarily to the can be asked what happens when the system deviates from perfect

mistaken intervention by the state in the working-of whai would balance. The tatter teaar to investigations of dynamic stability

otherwise be a perfect, self-adjusting system of competitive capital- or instabilitY. "a"e

ism. This system was in power in the nineteenth It is we[- Bookllisorganizedsoastostartwiththeeasiestcasefirstand

known that it failed to ensure either common eq"u"irttyr r(yie.a d charles progressslowlybutsteadilytowardthestabilityquestion.Chapter

Dickens on the conditions under which litile childr".r *ur" workod -s-eiptains what is meant by ,,Leontief technology" and studies

to death!) or economic stability: There were ,.panics,, every ten balanced growth in an economy with this technology' one which

years or so. The theory of this book shows that the failure of stahil- practices ;perfect thrift" (i'e., none but absolutely necessary con-

ity was not an accident, but rather was, and is, an inherent and in.s- sumption). The very severe restriction of Leontief technology is

capable feature of a freely competitive system with perfect mark.t relaxed in chapter i, devoted to von Neumann technology' Some

clearing. The usual equilibrium anarysis assumesstability fr.rn il,r economistsmaybeunfamiliarwithsomeofchapter4'scontents:

start, whereas actually the equilibrium is highly unstablcl' [h. krng in particular, the original results of von Neumann himself are not

run. The economic myths pushed by so many interestc<l prartir.s,r. acceptable economic"ally, since they are based upon a severe' in-

not only in contradiction to known history, but also to s,untl r,lrr..ry. deed cripplingly so, economic assumption' This assumption has

been remov"d i., lut", work by Kemeny, Morgenstern' andThomp-

B. Structure and contents son. Their results, which differ significantly as regards "optimality"

imp.Clicraratiopntes,r Sairsei nPtrheseennatetdu raelsoof.aninterlude,sinceitdeals,once

'l'lr. sl,ru<:ture of this work is as foilows: There arr. l'ivr. ,.lr.rk$.,,

rrr'lr'gl,li.*r. lir*,'rrlr, .,lp.xpxr>okp,'rfihaete I,tp)mlaecrye1 etnoc ec oafll Oatttiegnotpioonly :t oS uagny acrx IclccIrirn.i,tr,,'X, r,r,rrr r, , rtri,r7jrrr,,r,ry mmoordee,l .w" Tithhi sa i nstrteoadduyc-esst adteis scyiesttieomna, rnya m(aes lyo ptphoes e"do ptoe nn eDceesosnatriey)f

,\/rrrl.y ( l,)ir.hrrr.r lg{ig). consumption into the system, but without the additional compli-

--

-

tN't'ttol)lt(:'l'l()N t t

i PITDI,IMINAIIII,)S

cuasutiaoln tsh eaorisryin, gth firso mch agprtoewr tcho.n Atapinasr t sforomme ntheew dreessuclrtisp,t iaosns oocfia tthede iJnrcga rbs utht em iudecah olefs sa wliemlli tk ncyocwlen,a toa ceocnocneopmt iwstes.l l Iktn iosw snu ginge esntegdin ethear-t

with the possibility of "discretionary consumption goods," i.e., thctradecycleissuchalimitcycle.Finally,thechapterconcludes

goods which would not be produced at all by a "petfect thrift" with a digression on "naturaf price," relevant to the theory of

etioconnaorym yco. nAsnu mepcotionno mgyo oind sw ihsi cqhu acloitnastuivmeelyr s ddifefemraenndt sfruocmh dais pcreer-- v- a- luceh ainpt eercso ngo manicds 1.0 are devoted to the most important "schemat-

fect thrift economy. In particular, one can prove the existence of i",; u, opposed to detailed econometric, models of the trade cycle.

some highly peculiar solutions of the equations. Furthermore, un- ft u"""t"tator-multiplier model of Samuelson and the inventory

der cerbain not unreasonable conditions, these peculiar solutions cyc"l e model of Metzler are discussed in chapter 9' Chapter 10

tum out to be the only solutions of the system. tat es up in tum the Hicks model, the Frisch model, and the Good-

Chapter 6 retums to balanced growth, but this time with con- win model.

sumption permitted. The effect of consumption is to alter, dras- Econometricmodelsofcyclicalbehaviorarediscussedinchap-

tically, the nature of the solutions. In the perfect thrift system, terll.Thisisnotacriticaldiscussionofeconometricsassuch

the rate of growth of the economy equals the rate of retum to in- lirrut later), but rather the chapter is devoted to explaining,

vestors and is strictly limited: only a few discrete values (or per- ind cr"iotic-"izsin g, the stabitity results commonly obtained from such

haps only a single value) can exist for this common rate, on purely models. In conventional wisdom, the econometric models show

technological grounds. With consumption allowed, this is still true .ruu,rvthattheunderlyingbasiceconomyisstableabout.itsequi-

for the rate of return, but it is false for the rate of growth. The lat- iinrirr-. Chapter 11 provei that this conclusion is untenable' The

ter is free to take any value between instant collapse of the econ- Jata, when analyzed properly, show that the conventionally ac-

omy and the maximum which is achieved in a perfect thrift sys- Frisch -oa"t (a staUte system) is completely excluded'

tem. The actual value is related to the frugality, or lack of it, of ""pBt"oao k IV is on the economics of uncertainty. chapter 72 con'

the investors; it is not determined by the price system, nor does it tains a detailed criticism of the theory of expected utility' some

alter the price system. rational people may indeed use expected utility concepts for order-

The final chapter of book II, chapter 7 on dynamic stability, is ing theii pr"fur"rr"", among uncertain prospects' But-it is wrong

the heart and center of this work. This chapter contains the proof tfr"at att raiional people musiorder their preferences in that fashion'

of the basic dynamic instability theorem for a perfect thrift Leon- The chapter contains a number of arguments in favor of this view'

tief system, it shows that input substitution possibilities do nof de- Thematterisimportantinrelationtoinvestmentevaluationun.

stroy, or even seriously alter, this result, and the chapter ends with der uncertainty, the subject matter of chapter 13' Everyone' at

a discussion of the relevant stability literature. least after Keynes, ugr""t that investment is terribly important'

It may be noted that book II is restricted to "disaggregated" y"t, trr" standard trr"6rv of investment evaluation is in a very sad

growth theories and therefore contains no discussion of neoclassi- shape. It has no place for the method which most businessmen use

cal one-sector or two-sector growth models. This work does nof to decide on their investments in plant and machinery, the so-called

aim for encyclopedic coverage of the literature. The aim is not to "pay-back time" criterion. The iheory presented in chapter 13 is

"cover," but rather to "uncover," what is of main imporbance in ,rL* ura, unlike the conventional theory, is compatible both with

that literature. Specific reasons for omission of neoclassical aggre- a pay-back time criterion and with the presence of true uncertain-

gated growth models are given in section 7D;3 there one will also ty oi tfre future in the sense of Frank Knight (1921)' rather than

find the reasons for omitting all of tumpike theory and related beingrestrictedtothemerelyrisky,butnot:uricertain,..lotteries,,

subjects. of the usual approach. Book iV is not in itself dynamic economics'

Book III is devoted to theories of the trade cycle (what is termed but develops tools for such a study'

the business cycle in America). Chapter 8 is general, but very im- Book V retums to discuss three topics which were touched on

portant for what follows. The chapter starts from dynamic insta- earlieranddeferredforlaterconsiderationinordertoexpeditethe

bility, showing that this condition need not lead to ridiculous con- flow of the argument.

clusions about the global behavior of the system. Next there ap- 4prior references to limit cycles can be found in Samuelson (.19-3-!a)' Good-

*t;(ie;;;ieof, rszu;si[*,'t' (1e61, 1e65), and rorre (1e77)'

3Thir i* a short notation for chapter 7, section D.

lN'l'ltol)l t(:'l'loN I3

I2 PIIITI,IMINARII'S

Chapter 14 goes into more detail on the nineteenth-century trade miquo is prcsented explicitly in chapter 15, but his ideas are

cycle, in particular relation to Ricardo's predictions regarding fundamental for just about everything in this book.

landlords and industrialists. .Ihe relationship to the classical economists, Adam smith and

Chapter 15 contains the Tableau Economique of Francois Ques- David Ricardo in particular, is of a more mixed nature. on the one

nay (1760). He was one of the most important of all economists, hand, "classical" assumptions are used throughout, for example, a

and his contribution tends to be neglected unfairly and unduly. minimum subsistence wage which is converted into a fixed stan-

This chapter is not a simple presentation of the Tableau in its orig- dard bundle of wage goods. on the other hand, some of the main

inal form. Rather, it is a completely new study, using input-output tenets of classical economics are denied explicitly. These include:

concepts (which are themselves based on the work of Quesnay) the classical concept of exchange value (section 8E), the assertion

with quantities and prices kept separate, thus showing how both that the ,.invisible hand,' suffices to guide and determine the way

are determined within that system. the system develops (section 6D), and the dynamic stability of the

Finally, chapter 16, entitled "The Quicksand Foundations of classical equilibrium state (section 7B). The denial of say's law is

Econometrics," contains a detailed critique of econometric theory hardly novel after Keynes. But this denial has some interesting con-

and econometric methods. It is shown that this entire theory is a ,uqr"rr"", for an evaluation of what went wrong with Ricardo's

misapplication of the theory of mathematical statistics to an area pr"di"tionr about the relative position of landlords and industrial-

of research in which the basic assumptions underlying mathema- ists in his long run (chaPter 14).

tical statistics are not satisfied. Model builders are urged to avoid The denial of the classical concept of "value" implies that the

econometric methods, since those methods produce very much approach taken here is non-Marxist. Karl Marx maintained, cor-

harm and very little, if any, good. wr"h"totiye,' sthyastte tmhe. Slainbcoer twheeo drye noyf vthaelu ev aisl itdhiety eosfs etnhteia lc boanscise pfot ro hf isa

stable exchange value, we do not enter into discussions of value

C. Relationship to other theories in economics theorys or of the "Cambridge controversy."6 For the same reason,

A detailed discussion of the relationship of this book to other the- the views proposed in this book cannot claim descent from Mam.

ories in economics is, of course, entirely premature at this point. Naturally, this fact will not prevent some people from claiming

Rather, the purpose of this section is to indicate to the reader that this book is nothing but thinly disguised Mancism-just as it

some of the relevant issues and to locate where these issues are dis- will not prevent some other people from claiming that it is nothing

cussed in the body of the work. but reactionary bourgeois propaganda.

The approach taken here owes very much to that unfairly ne- Neoclassical economic theory is largely irrelevant for our study.

glected genius of economics, Dr. Francois Quesnay. In his Tableau It bases itself on a definition (Robbins 1935) which we do not

Economique, Quesnay sets out clearly that the economic system consider useful for dynamic economics, and most of the work is

of his day, just as much as the economic system of the nineteenth tied irevocably to states of economic equilibrium. Neoclassical

century or of today, is not like a "fair" with independent buyers theory has had more than a century to show what it can do in

and sellers who come together only via the market. Rather, the dynamic economics. Quite enough books already exist to cover

economic system has a circular flow, similar to the flow of blood *t ut tittt" there is that is realistic and useful. Thus neoclassical

in the human body. The buyers are at the same time sellers, the theory has been largely ignored in this volume. A few remarks can

sellers are at the same time buyers; there is thus a causal nexus be folnd in the following places: utility theory--ection 15E; op-

between sales and purchases much more explicit and stringent timality theory-sections 7D and 15E; production functions-

thaTnh ee nsvcisieangceed oinf ,e lceot nuosm siacys, hthaes p"aaiudc ati ohnea" voyf pWricaelra fso.r ignoring the siteyc ttihone o7cry ; -ncehocalapstseicra 1l 2g.x Towhitsh bmoookd eisls n-osfe cinttieonnd e7Dd ;a es xap cercitteiqdu eu tiol-f

insight of its great founder. Indeed, the only economists who have

made any significant progress in dynamic economics are those who us aEr."gr.i,i Blrloazklse)y, (ir1u9n6t? )(,r gBzuzr)m,Ie'Iiosrteisr h(i1m96a8 ()1, 9D1-9*r)e, -Pu a(s1in95e9tt.i) , (1-D9^7g7b-)!, (^s1r9a7rt.?a)'

have gone back, consciously or otherwise, to the Tableau Econo- (1960), Walsi'i (1980), von Weizsdcker (1973).

mique. Without the basic ideas of Quesnay, the problems of dy- 6Robirr.ot (1954); see also Blaug (1975), Bliss-(1975), C-lark (1978), Collard

namic economics are insurmountable. Quesnay's Tableau Econo- ( 197 3), Hartourt'(797 7, 197 2, 197 3, 19?6a), Harris ( 197 3)'