Table Of ContentSeptember1993

INPUT Vol.IV,No.12

MAP

Routeto:

Research

Bulletin

APublicationfromINPUT'SU.S.InformationServicesMarketAnalysisProgram

This Just In! INPUT'S 1993 U.S. Information

Services Market Forecast Completed!

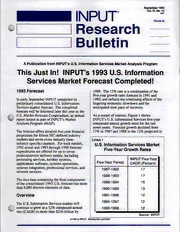

1993Forecast 1998. The12%rateisacontinuationofthe

five-yeargrowthratesforecastin1991and

InearlySeptemberINPUTcompletedits 1992,andreflectsthecontinuingeffectsofthe

preliminaryconsolidatedU.S.Information lingeringeconomicslowdownandthe

Servicesmarketforecast. Thecompleted anticipatedslowpaceofrecovery.

forecastwillbedeliveredlaterthisyearasthe

U.S.MarketForecastCompendium,anannual Asamatterofinterest,Figure1shows

reportissuedaspartofINPUT'SMarket INPUT'SU.S.InformationServicesfive-year

AnalysisProgram(MAP). compoundannualgrowthratesforthelast

sevenyears. Forecastgrowthdeclinedfrom

Theforecastoffersdetailedfive-yearfinancial 17%in1987and1988tothe12%projectedin

projectionsforfifteenSIC-definedindustry

marketsandsevencross-industry(non- Exhibit1

industry-specific)markets. Foreachmarket, U.S.InformationServicesMarket

1992actualand1993through1998forecast Five-YearGrowthRates

expendituresareofferedforuptoseven

product/servicedeliverymodes,including

processingservices,turnkeysystems, INPUTFive-Year

applicationssoftware,systemsoperations, Five-YearPeriod CAGR(Percent)

systemsintegration,professionalservices,and 1987-1992 17

networkservices.

1988-1993 17

Tofhethdeactoanbsaosleidcaotnetdai1n9i9n3gUt.hSe.fifnoarleccaosmtphoansenmtosre 1989-1994 15

than6,000discreteelementsofdata. 1990-1995 13

Overview 1991-1996 12

1992-1997 12

TheU.S.InformationServicesmarketwill

continuetogrowata12%compoundannual 1993-1998 12

rate(CAGR)tomorethan$236billionby

Source: INPUT

©1993byINPUT.Reproductionprohibited.

RESEARCHBULLETIN

1991,1992and1993,parallelingtherecent growingtrendtowardsoutsourcingof

trendsintheU.S.economy. informationsystemsresourcesasmore

businessesreturntocorecompetenciesinorder

Althoughtherewillnotbeanimmediatereturn toeffectivelycompeteinthe1990s.

tothego-goyearsofthe1980s,14of15

verticalmarketsshowveryrespectabledouble- WorstGrowth-Processingservices,systems

digitfive-yearcompoundannualgrowthrates, software,andturnkeysystemswillhavethe

rangingfrom10%to17%. Sixoftheseven lowestfive-yeargrowthrates. Processing

cross-industrymarketswillalsogrowfrom servicesarereactingtodecreasedornegative,

10%to17%overthenextfiveyears. growthforbothtransactionandutility

processingservices. Thebrights—potisthe

DeliveryModes: What'sUp? stronggrowthin"other"services suchas

disasterrecoveryservices.

BestandWorstFive-YearGrowthRates-

Exhibit2identifiesthethreedeliverymodes Thesystemssoftwareproductmarketisbeing

withthebestfive-yeargrowthrates,andthe affectedasfewerandfewermainframesare

threewiththeworstfive-yeargrowthrates. shipped,withacountertrendofincreasing

salesoflower-costPCsystemssoftware. By

BestGrowth-Applicationssoftwarebenefits 1998,themarketforsystemssoftwareproducts

fromtheboominsoft—wareproductswrittenfor fortheworkstation/PCplatformwillbe25%

workstationsandPCs anareagrowingat greaterthanthatformainframeplatforms.

morethantwicetherateofthemarketsfor Today,themainframeproductshavealmost

mainframe-andminicomputer-basedsoftware. 43%ofthesoftwareproductsmarket,while

By1998,workstation/PC-basedsoftware workstation/PCproductshave24%and

productswillcommandalmosttwo-thirdsof minicomputers33%.

theapplicationssoftwaremarket.

Exceptforafewindustry-specificmarkets,

Networkserviceswillcontinuetobeamajor suchasdiscreteandprocessmanufacturing,the

growthareaasbothelectronicinformation marketfornew,dedicatedturnkeysystems

servicesandnetworkapplicationsrespondto appearslimited. Althoughthereissomegrowth

Americanindustry'salmostinsatiabledemand projected,themajorityofitwilloccurin

foron-linedataandsophisticated turnkeysystem-relatedsoftwareproductsand

communicationssystems. Systemsoperations, professionalservicesandnotinequipment

especiallyintheareasofdesktopservicesand sales.

networkmanagement,willbenefitfromthe

Exhibit2

DeliveryModeFive-YearGrowth Rates

Best Worst

ApplicationsSoftware ProcessingServices

NetworkServices SystemsSoftware

SystemsOperations TurnkeySystems

Source: INPUT

2 e1993byINPUT.Reproductionprohibited.

INPUT

RESEARCHBULLETIN

Exhibit3

DeliveryMode1998MarketSizeExtremes

1998

Consideration DeliveryMode Size($B)

TheLargestMarket ApplicationsSoftware 48

TheSmallestMarkets SystemsIntegration 19

TurnkeySystems 20

Source: INPUT

MarketSizeExtremes-Exhibit3identifiesthe IndustryMarkets- -What'sHot?

deliverymodeswiththelargestandsmallest What'sNot?

1998markets.

TopMarkets-INPUT'Sresearchandanalysis

Applicationssoftwarenotonlyhasthelargest hasidentifiedtheindustrymarketsnotedin

shareoftheU.S.InformationServicesmarket, Exhibit4asthosewitheitherthebestISmarket

$48billionin1998,i—talsohasthethirdhighest growthratesorthelargestmarketsizein1998.

five-yeargrowthrate threepercentagepoints

abovetheISindustryasawhole. Thesmallest GrowthRates-Thegrowthratesofthediscrete

markets,systemsintegrationandturnkey andprocessmanufacturingindustriesare

systems,willstandat$19billionand$20 benefittingfromtheresurgenceofAmerican

billion,respectively,in1998. Butthesystems industry,retaildistributionfromthereturnof

integrationmarkethasa14%five-yearCAGR, theAmericanconsumerwithmoneytospend,

whileturnkeysystemshasonlyan8%rate. andtelecommunicationsfromthevirtually

Exhibit4

TopMarkets

ByFive-YearGrowthRate BySizein1998 (Dollars)

DiscreteManufacturing BankingandFinance

PlanningandAnalysis* DiscreteManufacturing

ProcessManufacturing FederalGovernment

RetailDistribution HealthService

StateandLocalGovernment ProcessManufacturing

Telecommunications StateandLocalGovernment

*Cross-industrymarket Source: INPUT

©1993byINPUT.Reproductionprohibited.

INPUT

RESEARCHBULLETIN

limitlesscornucopiaofnewandimproved Exhibit5

communications-basedproductsandservices. MarketsWithSlowest

Stateandlocalgovernmentspendingisgrowing

asmoreandmorereponsibilityandfundingis GrowthRates

beingshiftedtotheseareasfromthefederal

sector. Allindustriesuseplanningandanalysis •EducationandTraining*

etovebre-ttcehrandgeialngwbiutshitnheesscoemnpvlierxointmieenst.oftoday's •EngineeringandScientific*

•FederalGovernment

1998MarketSize-Thesixindustriesnoted •HumanResources*

uInnfdoerrm"aStiizoen"Sweirlvlicoefsfeirnth1e99l8a.rgeTshtemadriskcertestefoarnd •SalesandMarketing*

processmanufacturingandstateandlocal •Transportation

governmentmarketswillbenefitfromstrong

CAGRs,whilethefe—deralmarket,alwayslarge, *Cross-industrymarket Source: INPUT

willremainthatway eventhoughithasone

ofthelowestfive-yeargrowthrates. Banking Exhibit6

oapnpdorftiunnaintcees,wialnldcotnhteihneuaeltthoosfefrevricmeasjsoerctIoSr SmallestMarkets*in1998

(calledMedicalinlastyear'sindustrylist)

offersopportunitiesforbothclinicaland •EducationandTraining

administrativeapplications.

•EngineeringandScientific

Wsihdaet'ofstNhoetwHhoatt'-sEhxohtibciotisn—5atnhedm6aorfkfeetrtsheectfolrisp •SalesandMarketing

thataregrowingattheslowestrates,andthe Source: INPUT

onesthatwillbethesmallestmarketsin1998.

*AIIarecross-industrymarkets

SlowestGrowthRates-AsnotedinExhibit5,

fourcross-industrymarkets,plusthefederal specificISproductsandservices. Ascross-

sectorandthetransportationsector,willhave industryISservicesbecomeimportanttoan

theslowestgrowthratesduringtheperiod enterprise,theyarefoldedintothesuiteof

1993-1998. AsseeninExhibit4,thefederal applicationsorservicesmostusefultothat

sectorwillstillbeamajormarketin1998,but companyinthatindustry,andthusbecome

asvariousClintonAdministrationcost-savings industry-specific. Industry-specificISproducts

programsareimplemented,expendituresfor andservicesare,ofcourse,accountedforinthe

informationservicesareexpectedtodecline. appropriateindustrysector.

Thetransportationindustrysuffersfromunder

utilizationandoverregulation,andseemsto SmallestMarkets-Thethreesmallestmarkets

alwaysbedealingwithdecreasingprofits,but in1998areallcross-industrymarkets. They

itsgrowthrate(CAGR)isexpectedtoremainat alsosharethelowestcross-industrygrowth

asteady10%overtheforecastperiod. ratesandhavethesmallestrevenuebasesin

1993. INPUTnotesthatalthoughthesemarkets

Thefourcross-in—dustrymarketsareallvictims aresmall,theyarestillviable,andrepresent

ofthesametrend asthecomplexityof reasonableopportunitiesforthosevendors

businessgrows,itbecomesmoredifficultto choosingtoaggressivelypursuenichemarkets

identifyandsuccessfullymarketnon-industry- orspecializeintheareasnoted.

4 ©1993byINPUT.Reproductionprohibited.

INPUT

RESEARCHBULLETIN

Filmat11:00

Thisbulletinoffersavarietyofstatementsand

chartsillustratingwhichmarketsegmentsand

deliverymodesaregrowingornotgrowing,but

canonlyprovideabriefoverviewofmarket

sectoranddeliverymodegrowthpercentages

andamounts. Thisinformation,including

detailedmatricesofpreciseexpendituresand

percentagesbymarket,modeandsubmode,is

containedinINPUT'SMarketAnalysis

Program's(MAP)1993reportson22vertical

industryandcross-industrymarkets,andeight

deliverymodes.

INPUTReports-Eachreportoffersadetailed

analysisofthemanyfactorsinfluencingeachof

thesemarkets,considerstrendsandissues,

discussestheresultsandanalysisofhundreds

ofvendoranduserinterviews,andpresentsthe

reasonsbehindthenumbers. Alsoprovidedisa

detailedreconciliationtothe1992forecast.

1993ForecastCompendium-IntheFallof

1993,INPUTwillpublishits1993U.S.Market

ForecastCompendium,acompletelistingofthe

ISexpendituresforeachU.S.marketsegment

anddeliverymode. Inaddition,the

Compendiumwillcontainconsolidatedtotals

forbothindustriesanddeliverymodes. The

totalrepresentsthesizeoftheU.S.Information

Servicesmarket.

HowtoGetMoreInformation-Thosereaders

whohaveaninterestinanyofthereports

mentionedabove,shouldcalltheirINPUT

salesmanorcontactthenearestINPUToffice

notedonthebackofthisresearchbulletin.

ThisResearchBulletinisissuedaspartofINPUT'SInformationServicesMarketAnalysisProgram.

Ifyouhavequestionsorcommentsonthisbulletin,pleasecallyourlocalINPUTorganizationor

RobertL.GoodwinatINPUT,1280VillaStreet,MountainView,CA94041-1194,(415)961-3300.

©1993byINPUT.Reproductionprohibited. 5

INPUT

RESEARCHBULLETIN

About INPUT

ITIntelligenceServices

INPUTWorldwide

Since1974,informationtechnology(IT)usersandvendorsthroughoutthe Frankfurt

worldhavereliedonINPUTfordata,objectiveanalysis,andinsightful SudetenstraBe9

opinionstosupporttheirplans,marketassessmentsandtechnologydirections D-35428Langgons-

particularlyincomputersoftwareandservices. Clientsmakeinformed Niederkleen

decisionsmorequicklyandeconomicallybyusingINPUT'Sservices. TGeelr.m4a4n9y(0)6447-7229

CallustodaytolearnhowyourcompanycanuseINPUT'Sknowledgeand Fax+49 (0)6447-7327

experiencetogrowandprofitintherevolutionaryITworldofthe1990s. London

17HillStreet,Mayfair

LondonW1X7FB

DataBases Subscription Programs England

Tel.+44 (0)71493-9335

•U.S.FederalGovernment InformationServicesMarkets Fax+44 (0)71629-0179

- ITProcurements - Customerservices,network NewYork

••IIOpTT-pAVopIerpTtnludAinowciarattriDideaossntaDeBvaesleopment pptssrrueyororsvdfntiuekeccsemetsysssi,,osonpypsarseylortscaestetemesirsmsvosiincnsiegns(t,sFeeMsgr)rova,fittciaewosnan,dr,e 4TTFUe.ae0lSxa0..nFA11er.c((ak22n00,k11N)W)J8.8000B117u--6r006r4064B51l0vd.

Custom Projects - Wanoarllydsiwsideandcountry P24a,riasvenueduRecteur

Poincare"

Custommarketresearchand -- V5e-ryteiacralfoirnedcuassttrsyanalysis F7r5a0n1c6eParis

consultingprojectsaddressquestions Tel.+33 (1)46476565

onmarketstrategies,newproduct/ ITOutsourcingOpportunities Fax+33 (1)46476950

serviceideas,customersatisfaction - Systemsoperations SanFrancisco

levels,competitivepositionsand - Applicationsmanagement 1881LandingsDrive

merger/acquisitionoptions. - Desktopservices MCoAun9t4a0i4n3-V0i8e4w8

INPUTadvisesITbuyersonavariety - Networkmanagement U.S.A.

oisfspuelsa,nninicnlguadnindgiamspsleesmseinntgatthieon DCilrieecntti/oSnesrverApplicationsand TFealx.11((441155))996611--33936060

outsourcingofIToperations,assisting Tokyo

icnontthreacvtenndegoortsiealteicotni/oinmpprloecmeesnst,atainodn.in BSuyssitneemsssIPnrtoecgersastiCohnaanngde SKaainddaaBSuialkduimnag,-c4h-6o,

INPUTalsoevaluatesplansfor InformationServicesVendors Chiyoda-ku,Tokyo101

Japan

systemsandapplicationsdownsizing. - Profiles Tel.+81 33864-0531

OtherServices - Analysis Fax+81 33864-4114

EDI/ElectronicCommerce Washington,D.C.

Pmreeesteinntgast,ioetncs.,toonusdeirregcrtoiuopnss,ipnlIaTnnainndg UM.aSr.kFeetdseralGovernmentIT VS1ui9ie5tn3enaG5,a6l0VlAows22R1o8a2d

computersoftwareandservices ITCustomerServicesDirections U.S.A.

Aacnqiunitseirtniaotniso/npaalrbtanseirsshipssearcheson TFealx.11((770033))884477--66887720

EDI/ElectronicCommerceNewsletter

INPUT M&S45*01»93