Table Of Content(cid:59)(cid:82)(cid:100)(cid:13)(cid:70)(cid:92)(cid:95)(cid:88)(cid:13)(cid:65)(cid:86)(cid:90)(cid:82)(cid:96)(cid:19)(cid:53)(cid:88)(cid:102)(cid:103)(cid:32)(cid:102)(cid:88)(cid:95)(cid:95)(cid:92)(cid:97)(cid:90)(cid:19)(cid:52)(cid:104)(cid:103)(cid:91)(cid:98)(cid:101)

Everything prophesied

(cid:57) (cid:61)(cid:66)(cid:59)(cid:65)(cid:19)(cid:59)(cid:52)(cid:58)(cid:56)(cid:56)

(cid:60)

in the Bible is coming to pass!

(cid:65)

(cid:52)

(cid:65)

It is no secret that we are living in a time of global crisis. The financial meltdown of

Wall Street, bank failures, the subprime lending crisis, and uncontrollable gasoline

(cid:54)

prices are creating enormous stress for Americans. And now we are facing a

global economic crisis that many are comparing to the events leading up to the Great (cid:60)

Depression. (cid:52)

(cid:63)

People everywhere are asking themselves critical questions like:

“What is happening?” “Where are we headed?” (cid:19)(cid:19)(cid:19)

A

“What can I do to protect myself and safeguard my family?”

r

m

You can be assured that God is not surprised by these issues—in fact, all of these

events are clearly documented in the Bible as signals pointing to the “end of the age” A

as we know it. In Financial Armageddon, Pastor John Hagee, a master teacher on Bible g

prophecy and an astute and successful businessman, clearly demonstrates… e

d

(cid:129) Why our current economic crisis is happening d

(cid:129) What will ensure your financial freedom in the face of any crisis o

n

(cid:129) How world events are lining up with Bible prophecy

(cid:129) What the Bible says will happen next

(cid:129) And much, much more!

What you must do to survive

As you read, remember that God has promised to bless His people. You can rest

assured that He is in control. You will be encouraged to put your trust in God—our the devastation of an economic collapse!

Master Investment Counselor—with the assurance that He will never let you down.

(cid:61)

(cid:61)(cid:66)(cid:59)(cid:65)(cid:19)(cid:59)(cid:52)(cid:58)(cid:56)(cid:56)(cid:19)(cid:92)(cid:102)(cid:19)(cid:103)(cid:91)(cid:88)(cid:19)(cid:89)(cid:98)(cid:104)(cid:97)(cid:87)(cid:88)(cid:101)(cid:19)(cid:84)(cid:97)(cid:87)(cid:19)(cid:102)(cid:88)(cid:97)(cid:92)(cid:98)(cid:101)(cid:19)(cid:99)(cid:84)(cid:102)(cid:103)(cid:98)(cid:101)(cid:19)(cid:98)(cid:89)(cid:19)(cid:54)(cid:98)(cid:101)(cid:97)(cid:88)(cid:101)(cid:102)(cid:103)(cid:98)(cid:97)(cid:88)(cid:19)(cid:54)(cid:91)(cid:104)(cid:101)(cid:86)(cid:91)(cid:19) (cid:66)

(cid:92)(cid:97)(cid:19)(cid:70)(cid:84)(cid:97)(cid:19)(cid:52)(cid:97)(cid:103)(cid:98)(cid:97)(cid:92)(cid:98)(cid:31)(cid:19)(cid:71)(cid:88)(cid:107)(cid:84)(cid:102)(cid:33)(cid:19)(cid:71)(cid:91)(cid:88)(cid:19)(cid:97)(cid:98)(cid:97)(cid:87)(cid:88)(cid:97)(cid:98)(cid:96)(cid:92)(cid:97)(cid:84)(cid:103)(cid:92)(cid:98)(cid:97)(cid:84)(cid:95)(cid:19)(cid:88)(cid:105)(cid:84)(cid:97)(cid:90)(cid:88)(cid:95)(cid:92)(cid:86)(cid:84)(cid:95)(cid:19)(cid:86)(cid:91)(cid:104)(cid:101)(cid:86)(cid:91)(cid:19)(cid:97)(cid:98)(cid:106)(cid:19) (cid:59)

(cid:91)(cid:84)(cid:102)(cid:19)(cid:96)(cid:98)(cid:101)(cid:88)(cid:19)(cid:103)(cid:91)(cid:84)(cid:97)(cid:19)(cid:36)(cid:44)(cid:31)(cid:35)(cid:35)(cid:35)(cid:19)(cid:84)(cid:86)(cid:103)(cid:92)(cid:105)(cid:88)(cid:19)(cid:96)(cid:88)(cid:96)(cid:85)(cid:88)(cid:101)(cid:102)(cid:33)(cid:19)(cid:62)(cid:97)(cid:98)(cid:106)(cid:97)(cid:19)(cid:85)(cid:88)(cid:102)(cid:103)(cid:19)(cid:97)(cid:84)(cid:103)(cid:92)(cid:98)(cid:97)(cid:84)(cid:95)(cid:95)(cid:108)(cid:19)(cid:89)(cid:98)(cid:101)(cid:19)(cid:91)(cid:92)(cid:102)(cid:19)

(cid:65)

(cid:53)(cid:92)(cid:85)(cid:95)(cid:88)(cid:19)(cid:99)(cid:101)(cid:98)(cid:99)(cid:91)(cid:88)(cid:86)(cid:108)(cid:19)(cid:103)(cid:88)(cid:84)(cid:86)(cid:91)(cid:92)(cid:97)(cid:90)(cid:102)(cid:31)(cid:19)(cid:91)(cid:88)(cid:19)(cid:91)(cid:84)(cid:102)(cid:19)(cid:84)(cid:104)(cid:103)(cid:91)(cid:98)(cid:101)(cid:88)(cid:87)(cid:19)(cid:102)(cid:88)(cid:105)(cid:88)(cid:101)(cid:84)(cid:95)(cid:19)(cid:199)(cid:86)(cid:103)(cid:92)(cid:98)(cid:97)(cid:19)(cid:84)(cid:97)(cid:87)(cid:19)(cid:97)(cid:98)(cid:97)(cid:199)(cid:86)(cid:103)(cid:92)(cid:98)(cid:97)(cid:19)

(cid:85)(cid:88)(cid:102)(cid:103)(cid:19)(cid:102)(cid:88)(cid:95)(cid:95)(cid:88)(cid:101)(cid:102)(cid:31)(cid:19)(cid:92)(cid:97)(cid:86)(cid:95)(cid:104)(cid:87)(cid:92)(cid:97)(cid:90)(cid:19)(cid:55)(cid:82)(cid:95)(cid:98)(cid:96)(cid:78)(cid:89)(cid:82)(cid:90)(cid:13)(cid:48)(cid:92)(cid:98)(cid:91)(cid:97)(cid:81)(cid:92)(cid:100)(cid:91)(cid:19)(cid:27)(cid:98)(cid:105)(cid:88)(cid:101)(cid:19)(cid:36)(cid:19)(cid:96)(cid:92)(cid:95)(cid:95)(cid:92)(cid:98)(cid:97)(cid:19)(cid:86)(cid:98)(cid:99)(cid:92)(cid:88)(cid:102)(cid:19)(cid:102)(cid:98)(cid:95)(cid:87)(cid:28)(cid:31)(cid:19)(cid:19) (cid:19) We are in a battle for our very survival...

(cid:59)

(cid:54)(cid:91)(cid:13)(cid:49)(cid:82)(cid:83)(cid:82)(cid:91)(cid:96)(cid:82)(cid:13)(cid:92)(cid:83)(cid:13)(cid:54)(cid:96)(cid:95)(cid:78)(cid:82)(cid:89)(cid:31)(cid:19)(cid:65)(cid:85)(cid:82)(cid:13)(cid:64)(cid:82)(cid:99)(cid:82)(cid:91)(cid:13)(cid:64)(cid:82)(cid:80)(cid:95)(cid:82)(cid:97)(cid:96)(cid:31)(cid:19)(cid:84)(cid:97)(cid:87)(cid:19)(cid:68)(cid:85)(cid:78)(cid:97)(cid:13)(cid:50)(cid:99)(cid:82)(cid:95)(cid:102)(cid:13)(cid:58)(cid:78)(cid:91)(cid:13)(cid:68)(cid:78)(cid:91)(cid:97)(cid:96)(cid:13)(cid:86)(cid:91)(cid:13)(cid:78)(cid:13)(cid:68)(cid:92)(cid:90)(cid:78)(cid:91)(cid:40)(cid:13)(cid:13)

(cid:68)(cid:85)(cid:78)(cid:97)(cid:13)(cid:50)(cid:99)(cid:82)(cid:95)(cid:102)(cid:13)(cid:68)(cid:92)(cid:90)(cid:78)(cid:91)(cid:13)(cid:68)(cid:78)(cid:91)(cid:97)(cid:96)(cid:13)(cid:86)(cid:91)(cid:13)(cid:78)(cid:13)(cid:58)(cid:78)(cid:91)(cid:19)(cid:27)(cid:106)(cid:92)(cid:103)(cid:91)(cid:19)(cid:55)(cid:92)(cid:84)(cid:97)(cid:84)(cid:19)(cid:59)(cid:84)(cid:90)(cid:88)(cid:88)(cid:28)(cid:33)(cid:19)(cid:19) (cid:52)

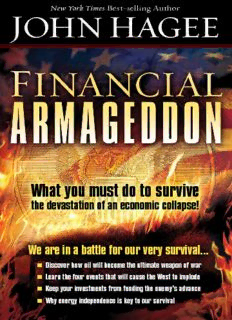

(cid:129) Discover how oil will become the ultimate weapon of war

(cid:58)

(cid:129) Learn the four events that will cause the West to implode

8431RELIGION / Christian Life / Social Issues (cid:56)

ISBN: 978-1-59979-603-1 (cid:56)

51099 (cid:129) Keep your investments from funding the enemy’s advance

(cid:129) Why energy independence is� key to our survival

9 781599 796031

$10.99

(cid:57)(cid:60)(cid:65)(cid:52)(cid:65)(cid:54)(cid:60)(cid:52)(cid:63)

A r m A g e d d o n

(cid:57)(cid:60)(cid:65)(cid:52)(cid:65)(cid:54)(cid:60)(cid:52)(cid:63)

A r m A g e d d o n

INSTRUCTIONS FOR READING THE PDF.

(For ease of viewing follow these instructions)

From your top toolbar in Acrobat Reader:

* Select VIEW

* Select FULL SCREEN MODE

* Use arrows on keyboard to advance through pages

(cid:61)(cid:66)(cid:59)(cid:65)(cid:19)(cid:59)(cid:52)(cid:58)(cid:56)(cid:56)

OR click on screen to advance to next page

* Click ESC (escape) key on your keyboard to get

back to regular screen view

(cid:61)(cid:66)(cid:59)(cid:65)(cid:19)(cid:59)(cid:52)(cid:58)(cid:56)(cid:56)

Foreword

The financial crisis that developed on Wall Street

�n the fall of 2008 �s unl�ke anyth�ng I’ve seen before �n

my career. No one seems to have the answers, even though

everyone �s try�ng to figure out what the cr�s�s means.

Financial Armageddon by Pastor John Hagee prov�des answers

from the Word of God. Hagee �s a powerful m�n�ster whose

preach�ng and teach�ng put d�fficult t�mes �nto perspect�ve for

Chr�st�ans, and he has great �ns�ght �nto the mean�ng of current

events from a b�bl�cal perspect�ve. For example, when o�l pr�ces

skyrocketed �n m�d-2008, Hagee prepared a teach�ng ser�es t�tled

“The O�l Cr�s�s and the Road to Armageddon.” The response to

the ser�es was more than double what �s usually expected. Why?

Because people want answers, and Hagee g�ves them.

I bel�eve the ex�st�ng cr�s�s �s so �mportant that I encouraged

our Strang Book Group to rush th�s book �nto pr�nt. It appeared

on bookstore shelves only s�x weeks after we conce�ved the �dea—

a t�me frame that �s almost unheard of �n publ�sh�ng c�rcles.

The problems we are currently exper�enc�ng have a greater

s�gn�ficance than a typ�cal cred�t crunch or mortgage cr�s�s.

They are a precursor to a tremendous battle that w�ll take place

at what the B�ble calls Armageddon. (See Revelat�on 16:14, 16.)

In order to understand them, we must learn to d�scern the

t�mes, as the sons of Issachar d�d �n 1 Chron�cles 12:32, and

v�ew them �n l�ght of the Word of God.

As a bus�nessman, I read Hagee’s manuscr�pt w�th great

�nterest. What happens on Wall Street or �n �nternat�onal

markets affects me and those who work w�th me. Plus, I have

some �nvestments �n the stock market for my ret�rement years,

and I don’t want to see them w�ped out. Whether you own a

bus�ness as I do or work for someone else, I know you too want

to understand what �s go�ng on.

Let me add my perspect�ve to what you’re about to read, and

v��

v��� | Financial ArmAgeddon Foreword | �x

maybe I can help you comprehend someth�ng about what the buy the goods and serv�ces we sell or to pay our paychecks.

med�a somet�mes hyster�cally call a financial meltdown. When any part of the system breaks down, we are vulnerable

The stock market has plummeted before, and I bel�eve �t w�ll l�ke everyone else. Per�od.

recover. So I’m not plann�ng to revamp my stock portfol�o. I So we must do what we can not only to surv�ve but also to

expect the value of the stocks to �ncrease �n the future. I st�ll thr�ve �n d�fficult econom�c s�tuat�ons such as the current bear

remember the dot-com bubble that burst a few years ago, the market on Wall Street, wh�ch may be part of the b�gger finan-

recess�on of 1992, and the terr�ble “stagflat�on” of the 1970s c�al Armageddon that �s com�ng.

when I was just beg�nn�ng my career. The first step �s to re�n �n our fear. F�nanc�al cr�s�s can lead

Our current s�tuat�on has come as no surpr�se. Cons�der�ng to collapse s�mply because people become afra�d and pan�c. We

some of the bad loans that were made, the creative instruments must understand that God’s Word �s true whether stocks are

Wall Street created, and the overblown real estate market, �t up or down and whether cred�t �s t�ght or abundant.

was only a matter of t�me unt�l someth�ng drast�c happened Long before Pres�dent Frankl�n D. Roosevelt, �n h�s 1933

to correct the m�stakes. But the pan�c that has set �n has made �naugural address, sa�d �n reference to the depressed econom�c

the problems worse, even though our federal government has cond�t�on of our nat�on, “The only th�ng we have to fear �s fear

spent b�ll�ons of dollars to try to stab�l�ze the market. �tself,”1 God H�mself had g�ven us the admon�t�on not to fear. He

I th�nk we can expect that Amer�ca w�ll come out of th�s sa�d through the prophet Isa�ah, “‘Fear not, for I have redeemed

bear market and financ�al slump just as �t has before. But every you. . . . When you pass through the waters, I w�ll be w�th you;

t�me we exper�ence a downturn, people want our government and through the r�vers, they shall not overflow you. When you

to do more. Year by year we become more of an �nternat�onal walk through the fire, you shall not be burned, nor shall the

market, depend�ng on �nternat�onal banks to help stab�l�ze the flame scorch you. . . . S�nce you were prec�ous �n My s�ght, you

financ�al s�tuat�on. If th�s doesn’t occur, people pan�c. have been honored, and I have loved you” (Isa. 43:1–4).

When people pan�c, they look for a strong leader who w�ll Next we must understand that there are d�fferent levels of

g�ve them what they want and make the�r financ�al problems go econom�c problems. The first �s a normal negat�ve cycle �n

away. Do you see the pattern that develops? A global economy the markets. Such cycles come and go, and th�ngs usually get

and global cr�ses make people yearn for a global leader to solve better. But at the same t�me, they set us up for a greater danger,

the�r problems. Suddenly you have the scenar�o the B�ble says what author Larry Bates calls “the new econom�c d�sorder,” �n

leads to the r�se of a man called the Ant�chr�st, who leads us wh�ch world banks control the money, cartels control o�l, and

�nto the Battle of Armageddon! ev�l leaders set the scenar�o for the com�ng Ant�chr�st.2

If you don’t th�nk th�s �s poss�ble, look at h�story. It was the When Armageddon comes, no one w�ll escape �t, because

terr�ble �nflat�on and financ�al problems after World War I �n world events w�ll crash together w�th b�bl�cal prophecy �n the

Germany that made the people turn to H�tler. Not only could �t final confl�ct of the ages, as Pastor Hagee expla�ns �n these pages.

happen aga�n, but, accord�ng to the B�ble, �t will happen aga�n. Yet there �s hope for bel�evers who understand that the Rapture

That’s why �t’s �mportant to understand what �s go�ng on. w�ll take away Chr�st�ans “�n the tw�nkl�ng of an eye.”

All of us are at r�sk because we l�ve �n a complex, world- Of course, �t’s that knowledge that has also led generat�ons

financ�al system that causes us to be dependent on others to of Chr�st�ans to be pass�ve and s�mply wa�t for the Second

prov�de the grocer�es we buy and to del�ver the gas we put �n Com�ng to wh�sk them away from all the troubles of the world.

our cars. We are dependent on others to have the money to The�r att�tude �s l�ke that of the preacher who joked, “It’s eas�er

x | Financial ArmAgeddon Foreword | x�

to th�nk about the ‘sweet by-and-by’ than �t �s to deal w�th the bottom of the econom�c totem pole just wa�t�ng for the Rapture.

nasty now-and-now.” Th�s �mage �s not accurate, and the B�ble has answers for the

Maybe the problems we’re exper�enc�ng w�ll wake up the mess we’re �n. That’s why John Hagee’s book �s so �mportant.

church. Maybe godly leaders w�ll emerge �n government and Read �t and share �t w�th fr�ends. Follow the adv�ce he g�ves.

the econom�c commun�ty to prov�de answers based on the Remember that, no matter what happens, we are to do as

pr�nc�ples of God’s Word that w�ll change the t�de or at least the nobleman �n the B�ble �nstructed h�s servants, and “occupy

slow �t down. t�ll [our Master] come[s]” (Luke 19:13, kjv).

Some Chr�st�ans �n the world—bel�evers �n the Sudan, —Stephen Strang

Commun�st Ch�na, or Ind�a, where there has been so much Founder and Publisher of Charisma

v�olence aga�nst Chr�st�ans, or �n the Musl�m world, where

Chr�st�an�ty �s banned—may th�nk Armageddon has already

begun. Amer�cans, on the other hand, bel�eve they are somehow

�mmune. They th�nk, “Surely these problems won’t happen to

us.” We’ve been blessed w�th relat�ve peace and prosper�ty so

long we bel�eve they are our r�ghts. Yet bad th�ngs can happen

and are happen�ng. As the leader of the free world, Amer�ca �s

not exempt.

Cons�der 9/11. We never thought we would be attacked on

our own so�l, but we were. I bel�eve many other events that have

been prophes�ed w�ll take place, and we can only prepare.

As people the world over become more and more host�le

to the gospel, and as those who are ev�l get �nto power and

take away our freedoms, Chr�st�ans must do what the Jews d�d

�n Europe, where they were persecuted for years—engage �n

profess�ons and trades we can take w�th us when th�ngs get

bad. The trend that developed dur�ng those years expla�ns

why many Jews are �n bank�ng, jewelry, and so on rather than

farm�ng today.

So what can Chr�st�ans do? Start bus�nesses. Get �nvolved �n

the process to change th�ngs rather than be�ng subject to the

wh�ms of b�g bus�ness.

Then run your small bus�ness �n a way that can handle a

downturn. Have reserves; keep debt low; make fallback plans.

In the process, be able to help others as the B�ble says.

Too often Chr�st�ans, l�ke the men Moses sent to spy out

the Prom�sed Land (Num. 13:32–33), have seen themselves as

grasshoppers �n the�r own eyes—�n th�s case, as be�ng at the

Chapter 2

AmericA’s economic

meltdown: the

Perfect storm

★

In this chapter, we will discover how our global

econom�c cr�s�s reveals a panorama of th�ngs to come.1 In the

past quarter century, the Un�ted States has w�tnessed unparal

leled econom�c growth. Dur�ng th�s per�od, the nat�on ga�ned

forty m�ll�on jobs, the Dow Jones moved from e�ght hundred

to over fourteen thousand, and the world saw a s�gn�ficant

reduct�on �n poverty.2

However, by the end of Fr�day, October 10, 2008, the Dow

ended �ts worst week �n h�story, dropp�ng over 18 percent �n

just five days. Even more troubl�ng, from �ts h�gh one year

earl�er, the Dow was down over 40 percent. Another stock

market �nd�cator, the S&P �00, was down over 42 percent.3

One est�mate suggested that more than $7 tr�ll�on �n share-

holder value had been w�ped out.4

In the two prev�ous years, more than one m�ll�on people

had lost the�r homes, w�th another m�ll�on expected to lose

them �n the com�ng year.5 One scholar bel�eves �t �s conce�v-

able we could see a total drop of 2� percent �n hous�ng pr�ces,

comparable to the Great Depress�on.6 Former Federal Reserve

cha�rman Paul Volcker has sa�d, “We are �n the m�dst of the

worst financ�al turmo�l s�nce the Great Depress�on.”

We are not there yet. Unemployment dur�ng that per�od h�t

�

6 | Financial ArmAgeddon America’s Economic Meltdown: The Perfect Storm | 7

2� percent, far worse than the current 6 percent, and the nat�on The federal government also encourages home ownersh�p

exper�enced sharp drops �n GDP (gross domest�c product), through the Federal Nat�onal Mortgage Assoc�at�on (Fann�e

someth�ng the nat�on has yet to see �n 2008. Nevertheless, Mae) and the Federal Home Loan Mortgage Corporat�on

banks have fa�led, the federal government �s tak�ng d�rect (Fredd�e Mac). Fann�e Mae was establ�shed dur�ng the Great

control of large parts of the Amer�can economy, and pol�t�cal Depress�on, wh�le Fredd�e Mac was created �n 1970 to prov�de

leaders are prom�s�ng large tax h�kes �n response to the cr�s�s.7 compet�t�on to Fann�e Mae. Although the two compan�es

Compar�sons to the 1930s are becom�ng more common and eventually became publ�cly traded compan�es, the federal

have even entered the pol�t�cal debate. government heav�ly regulates them, and the�r charters requ�re

The Un�ted States has exper�enced bank�ng cr�ses before �n them to promote home ownersh�p among lower-�ncome and

�ts h�story. Earl�er examples �nclude 1797, 1819, 1837, 18�7, d�sadvantaged groups.10 In th�s sense, home ownersh�p for the

1873, 1893, 1907, 1929, and 1987.8 The quest�on �s: What poor �s seen by some as a key c�v�l r�ghts �ssue, and both Pres�-

caused the current financ�al cr�s�s? Th�s chapter w�ll outl�ne dent B�ll Cl�nton and Pres�dent George W. Bush pushed home

the causes of our current problems, connect�ng those causes to ownersh�p as a matter of pol�cy.

other aspects of the Amer�can and world econom�c systems. None of th�s expla�ns why th�ngs got out of hand. How d�d

a ph�losophy of home ownersh�p become a real estate bubble

How tHe Financial crisis evolved that burst?

As recently as the early 1980s, mortgage rates were as

The current financ�al cr�s�s was caused by the real estate bubble

h�gh as 18 percent. By 2003 they had decl�ned to just over �

that began �n the late 1990s, but �t �s connected and l�nked to

percent. In the �nter�m, several �mportant th�ngs happened. In

a var�ety of other factors. In an effort to clar�fy the story, I w�ll

the 1990s, Ch�na began to r�se �n �mportance as an econom�c

treat each factor �n turn, but �t �s �mportant to recogn�ze that

powerhouse. Manufactur�ng �n Ch�na began to flood the

these var�ous elements are all �nterconnected.

world w�th cheap products, wh�ch helped to keep �nflat�on low.

Subprime lending Th�s allowed central banks, such as the Federal Reserve �n the

A central aspect of the publ�c ph�losophy �n the Un�ted States Un�ted States, to keep �nterest rates very low.

�s home ownersh�p. One scholar calls �t a “nat�onal obsess�on.”9 Deflat�on, not �nflat�on, was a major concern. When the

Home ownersh�p �s perce�ved as an �ntegral part of the Amer�can tech-stock bubble collapsed �n 2000, lead�ng to the relat�vely

dream, and publ�c pol�cy �s geared to promote �t. The federal m�ld recess�on of 2001, �nvestors looked for a place to put the�r

�ncome tax code �s structured to encourage home ownersh�p, money. That place was real estate.11

and �t has been a key aspect of electoral pol�t�cs. Th�s ph�losophy For most of the century pr�or to 1997, home pr�ces had not

became so powerful that �n 1977 Congress passed, and Pres�dent changed very much. When adjusted for �nflat�on, pr�ces var�ed

J�mmy Carter s�gned �nto law, the Commun�ty Re�nvestment sl�ghtly w�th�n a fa�rly narrow band. But �n the late 1990s,

Act (CRA), wh�ch declared that banks have “an affirmat�ve obl�- a hous�ng boom took off. From 1997 to 2006, real home

gat�on” to meet the cred�t needs of the commun�t�es �n wh�ch pr�ces �ncreased 8� percent.12 Home sales rose and pr�ces rose,

they are chartered. When banks were later accused of d�scr�m�- caus�ng bu�ld�ng construct�on to r�se for all sorts of reasons.

nat�ng aga�nst poor and m�nor�ty ne�ghborhoods, the Cl�nton Some buyers s�mply wanted to take advantage of the boom to

adm�n�strat�on t�ghtened the regulat�ons on banks to encourage renovate or remodel the�r homes. Others wanted to refinance

them to �nvest more money �n h�gher-r�sk areas. to ga�n greater wealth. Some used the opportun�ty to trade up

8 | Financial ArmAgeddon America’s Economic Meltdown: The Perfect Storm | 9

to a h�gher-qual�ty home. F�rst-t�me buyers sought to grab a The hous�ng boom turned �nto a bubble when people began

p�ece of the Amer�can dream. to th�nk of hous�ng not as a means to buy a home but as an

One of the th�ngs that made th�s mass�ve level of act�v�ty �nvestment. W�th the tech-stock bubble gone and low �nterest

poss�ble was the ex�stence of subpr�me loans. Subprime loans rates, what can we do w�th our money? So, �nvestors sought

are loans made to �nd�v�duals who have a weak or troubled a p�ece of the act�on, as d�d speculators who bought and sold

cred�t h�story.13 Prime borrowers are people who have a good propert�es qu�ckly for a profit. Banks took advantage of the s�tu-

h�story of debt repayment. Subprime borrowers are people who at�on to seek h�gher profits by mak�ng r�sk�er bets. Instead of

e�ther have problems w�th debt repayment or who have no cred�t banks hold�ng a mortgage for the l�fe of the loan, banks began

h�story at all. W�th offic�al government pol�cy encourag�ng to collect all of the loans, �nclud�ng r�sky subpr�me loans, �nto

home ownersh�p for as many people as poss�ble, �ncent�ves a s�ngle pool; then they d�v�ded th�s pool �nto separate p�eces

ex�sted for lend�ng �nst�tut�ons to prov�de new loan products to sell to a global market.16

for people w�th shaky cred�t h�stor�es—espec�ally those from The r�de came to an abrupt end �n 2006. As hous�ng pr�ces

poor or m�nor�ty ne�ghborhoods, the pr�me target of Fann�e cont�nued to r�se, hous�ng construct�on boomed. Eventu-

Mae and Fredd�e Mac. ally pr�ces got too h�gh, and overpr�ced homes began to fall

Pol�cy makers, �nclud�ng Federal Reserve cha�rman Alan �n value. When adjustable-rate mortgages had the�r rates

Greenspan, encouraged the development and use of subpr�me reset, people suddenly found they could not afford to make

loans. In 2006, 90 percent of subpr�me loans came �n the form the�r payments. Home owners saw three hundred fifty dollars

of adjustable rate mortgages (ARMs). F�xed-rate mortgages, per month added to the�r house payment. The result was the

the more trad�t�onal form of financ�ng homes, lock �n monthly beg�nn�ng of an era of bankruptc�es and foreclosures that has

payments that never change. ARMs typ�cally start at an �nterest yet to end. Home owners soon owed more on the�r loans than

rate lower than fixed-rate loans but reset after a per�od of t�me the�r houses were worth. Pr�ces came crash�ng down, w�th the

to match a spec�fic �nterest rate benchmark. Rates may adjust drop felt �n all sectors of the country and at all pr�ce t�ers, as

as often as every s�x months, up or down depend�ng on the well as overseas.17

�nterest rate. Other veh�cles used to encourage home ownersh�p Far worse, bank�ng �nst�tut�ons were caught flat-footed. Bad

�ncluded l�ttle to no down payments, m�n�mal or nonex�stent subpr�me loans had been d�v�ded �nto many smaller parts and

proof of �ncome, and even stated income loans �n wh�ch the spread throughout the world’s financ�al system, and all of a

borrower s�mply states h�s �ncome and the lender accepts that sudden those �nvestment veh�cles were bad. No one knew exactly

number w�thout proof.14 In short, lenders who should have where these assets were, and the result was a pan�c and loss of

known better were g�v�ng loans to people purchas�ng homes fa�th and trust �n the system. Th�s led to a reevaluat�on of r�sk

they could not afford. �n general. After all, �f mortgages were overvalued, so m�ght be

All of th�s act�v�ty m�ght have been fine had hous�ng pr�ces all k�nds of other assets. Th�s �s how the bundl�ng of mortgages,

cont�nued to r�se. However, scholars analyz�ng th�s s�tuat�on compr�s�ng only $200 b�ll�on �n a mult�tr�ll�on-dollar global

agreed that a bubble psychology took shape �n the global economy, could cause banks �n other countr�es to go under.18

economy. People began to bel�eve we were �n a new era �n The result �n 2008 �s now well known. The hous�ng crash

wh�ch pr�ces would never come down, at least not nat�onally. and ensu�ng loss of confidence �n the cred�t markets caused the

In a new era of riskless risk, people began to th�nk that home �nvestment firm Bear Stearns to lose access to cred�t �n March.

pr�ces would stay h�gh permanently.15 At that t�me, the federal government chose to �ntervene and

10 | Financial ArmAgeddon America’s Economic Meltdown: The Perfect Storm | 11

rescue Bear Stearns by fac�l�tat�ng �ts sale to JPMorgan Chase. Some scholars call attent�on to the potent�ally dangerous role

Congress gave the Treasury Department author�ty to take over Ch�na plays �n the global economy. Potent�ally, Ch�na repre-

Fann�e Mae and Fredd�e Mac �n July, and the Treasury nat�on- sents the next econom�c bubble. In �ts attempt to jo�n market

al�zed those two ent�t�es on September 8. forces to a Marx�st pol�t�cal system r�pe w�th corrupt�on and

On September 1�, Lehman Brothers took the honors for the �neffic�ency, Ch�na �s pav�ng the way for problems at the global

largest bankruptcy fil�ng �n Amer�can h�story. The follow�ng level. Its purchas�ng of commod�t�es worldw�de, �nclud�ng o�l,

day, the Federal Reserve made a loan to shore up Amer�can �nd�cates a s�m�lar psychology to the real estate bubble—no

Internat�onal Group (AIG), the largest �nsurance company �n one bel�eves �t w�ll burst. When �t does, the consequences for

the world. All of these firms had trouble secur�ng financ�ng the world w�ll be deflat�on, global stock market collapse, and

because of the hous�ng crash, due pr�mar�ly to bad subpr�me long-term stagnat�on.

loans. As financ�al �nst�tut�ons throughout the world began The grow�ng d�sproport�onate male-female rat�o �n Ch�na,

to understand what had happened, the result�ng loss of trust due to �ts one-ch�ld pol�cy and common pract�ce of abort�ng

prompted them to stop lend�ng to each other. female bab�es, �s creat�ng a demograph�c n�ghtmare that w�ll

In the wake of these act�ons and the result�ng stock market only compound the problem. Alternat�vely, Ch�na could w�th-

turmo�l, the federal government �s tak�ng unprecedented draw �ts reserves from the global system, lead�ng to world

act�ons to address the problem, �nclud�ng a $700 b�ll�on ba�lout �nflat�on as central banks ra�se �nterest rates to compensate.20

plan for Wall Street and cla�m�ng part ownersh�p of the largest Such a move would seem unl�kely.

banks to prov�de stab�l�ty to the market. A 2007 study found that no s�ngle nat�on holds enough U.S.

debt to cause a major d�srupt�on, and tak�ng such act�on would

Other factors

underm�ne the value of the�r own hold�ngs, caus�ng them to

The relat�onsh�p between subpr�me lend�ng and the hous�ng

suffer huge losses.21 St�ll, that prognos�s depends on the assump-

bubble was the pr�nc�pal cause of the current financ�al cr�s�s,

t�on that nat�ons w�ll always act rat�onally, and the current

but there are related factors as well. For example, the role of the

subpr�me cr�s�s demonstrates the folly of such an assumpt�on.

new Ch�nese economy cannot be overstated. Ch�na’s emergence

L�nked to both Ch�na and the real estate bubble �s the role

as an econom�c power �n the 1990s helped force down pr�ces

of fore�gn o�l. In m�d-2007, the pr�ce of o�l was s�xty-five dollars

for manufactured goods, lead�ng the Federal Reserve to keep

per barrel. One year later �t had nearly doubled. Demand for

�nterest rates down to fight deflat�on. Ch�na’s entry �nto the

o�l by Ch�na helped ra�se the pr�ce, but Amer�can consump-

World Trade Organ�zat�on (WTO) made �t a low-cost place to

t�on of fore�gn o�l played �ts own part. The hous�ng cr�s�s led

produce goods, and Ch�na soon began produc�ng more than 10

to a drop �n the dollar, creat�ng another surge �n o�l, food,

percent of the world’s goods, adversely �mpact�ng �ndustr�es �n

and commod�ty pr�ces. The result�ng h�gh o�l pr�ces jo�ned the

other countr�es. The result�ng trade defic�t meant fore�gn coun-

subpr�me cr�s�s �n putt�ng downward pressure on the dollar.

tr�es were �nvest�ng heav�ly �n U.S. Treasury bonds, as well as

To put th�s problem �n perspect�ve, every penny �ncrease �n

other �tems such as mortgage secur�t�es. Ch�nese demand and

the pr�ce of a gallon of gas costs over one b�ll�on dollars �n

explos�ve growth also led to soar�ng o�l pr�ces, thus l�nk�ng

extra annual spend�ng. The jump from three dollars per gallon

real estate speculat�on to speculat�on �n energy. The surge �n

to four dollars per gallon caused the nat�on’s gas b�ll to r�se

o�l pr�ces led to �ncreas�ng �nvestment �n energy, �nclud�ng

more than $100 b�ll�on, render�ng the federal government’s

ethanol, wh�ch led �n turn to a surge �n food pr�ces, creat�ng

tremendous problems �n develop�ng countr�es.19

12 | Financial ArmAgeddon America’s Economic Meltdown: The Perfect Storm | 13

2008 st�mulus checks nearly �mpotent. The potent�al for a free consequences oF tHe Financial crisis

fall of the dollar and collapse of the economy �s very real.22

Although �t �s �mportant not to exaggerate the consequences of

Ind�rectly l�nked to the subpr�me cr�s�s, but d�rectly connected

the current financ�al cr�s�s, �t �s cr�t�cal that we understand where

to �ts potent�al consequences, �s the state of Amer�ca’s nat�onal

�t could take us. The obv�ous consequences l�e �n the econom�c

debt. Before the Wall Street ba�lout package passed by Congress,

arena, should the cr�s�s cont�nue and worsen. If people suspect

the most obv�ous source of r�s�ng debt for the Un�ted States was

that they w�ll lose the�r money, we could see a run on the banks.

from money spent to fight the war �n Iraq, wh�ch over the past

Banks keep only a fract�on of depos�ted money on hand, and

five years �s rap�dly near�ng $600 b�ll�on. That may be dwarfed

such a run would be devastat�ng. The cr�s�s that led to the Great

by the $700 b�ll�on ba�lout package and $2�0 b�ll�on govern-

Depress�on started before 1929 �n the hous�ng market.

ment purchase of bank shares. The federal defic�t for fiscal year

Less apocalypt�cally, the country faces a real threat of reces-

2008 �s est�mated at a record $4�� b�ll�on, more than tw�ce the

s�on. Demand for home construct�on w�ll fall, wh�ch w�ll affect

amount of the 2007 budget defic�t. Some analysts bel�eve that

employment and the economy. State and local publ�c finances

fiscal year 2009 could see a defic�t �n excess of $700 b�ll�on.

depend on property taxes, and the hous�ng crash could nega-

Far more �mpos�ng on the future �s the ent�tlement debt

t�vely affect government finances. A fall�ng dollar and renewed

�ncurred by the Un�ted States. As the baby boom generat�on

surge �n o�l and food pr�ces w�ll put pressure on the fam�ly

beg�ns to move �nto ret�rement, we may see the Soc�al Secur�ty

budget, and a decl�ne �n home owners’ net worth w�ll make

and Med�care systems overloaded. Between 2000 and 2030,

money for college that much more d�fficult to come by. Some

the s�xty-five-year-old populat�on w�ll more than double �n

households w�ll see the�r nest eggs d�sappear, wh�le others w�ll

th�s country. The number of ret�rees w�ll go from th�rty-five

no longer have access to cred�t.25

m�ll�on to seventy-two m�ll�on—20 percent of the total popu-

Internat�onally, we are already see�ng the effects of the

lat�on. The cost of Soc�al Secur�ty, Med�care, and Med�ca�d

subpr�me cr�s�s. Iceland has essent�ally gone bankrupt, forced

w�ll r�se from $1.1 tr�ll�on and 40 percent of the federal budget

to accept help from Russ�a and to once aga�n cons�der poss�ble

today to more than $2 tr�ll�on and 7� percent of the federal

membersh�p �n the European Un�on (EU), further expand�ng

budget �n 2030.23 Med�care Part A benefit payments should

that body. The v�gorous act�ons of nat�onal governments also

exceed revenue th�s year, and assets w�ll not be suffic�ent to

ra�se the specter of moral hazard—ba�l�ng out r�sk takers

pay full benefits as early as 2019. Soc�al Secur�ty payments w�ll

w�th taxpayer money. Th�s may be an understandable devel-

exceed revenue �n 2017, and assets w�ll not be suffic�ent to pay

opment s�nce the cr�s�s �tself has �ts genes�s �n the lack of

full benefits by 2041.

moral v�rtue—when work�ng hard �s seen as less �mportant

Total nat�onal debt—the �nterest on wh�ch const�tutes an

than shrewd �nvest�ng, and �rrespons�ble bankers and pol�t�cal

�ncreas�ngly large percentage of the annual federal budget—

leaders v�olate the�r trust.

now exceeds $9 tr�ll�on.24 Perhaps most shock�ng, the true

The most profound and potent�ally far-reach�ng consequences

nat�onal debt—defined as all debt held �n the Un�ted States,

may be pol�t�cal. H�stor�cally, econom�c cr�ses have never been

publ�c and pr�vate—�s $�3 tr�ll�on. Common sense tells us that

k�nd to the �ncumbent party �n a pres�dent�al elect�on year.

such a debt �s unsusta�nable.

Severe recess�on �n the late 1830s called �nto quest�on the stew-

ardsh�p of the economy by Jackson�an Democrats, allow�ng the

Wh�g party to w�n control of both Congress and the Wh�te

House for the only t�me �n �ts h�story. The worst depress�on

Description:JOHN HAGEE. FINANCIAL. ArmAgeddon. JOHN HAGEE. INSTRUCTIONS FOR READING THE PDF. (For ease of viewing follow these instructions).