Table Of ContentT E T

HE CONOMIC IMES

DON’T WRITE

OFF GOLD

JUST YET

P11

www.etwealth.co | Ahmedabad, Bengaluru, Chennai, Hyderabad, Kolkata, Mumbai, New Delhi, Pune | May 23-29, 2022 | 24 pages | `8

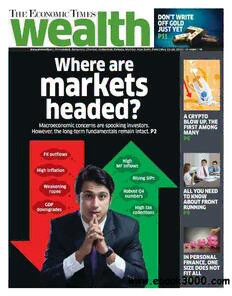

Where are

markets

headed?

A CRYPTO

BLOW UP, THE

Macroeconomic concerns are spooking investors.

FIRST AMONG

However, the long-term fundamentals remain intact. P2

MANY

P6

FII outf lows

High

MF inf lows

High inf lation

Rising SIPs

Weakening

rupee Robust Q4 ALL YOU NEED

numbers TO KNOW

ABOUT FRONT

GDP

High tax RUNNING

downgrades

collections P9

IN PERSONAL

FINANCE, ONE

SIZE DOES NOT

FIT ALL

P13

cover ssttoorryy

02 The Economic Times Wealth May 23-29, 2022

WHERE ARE

MARKETS HEADED?

Macroeconomic concerns are spooking investors. However, the

long-term fundamentals of Indian equities remain intact.

S

E

G

A

M

Y I

T

T

E

G

By Sameer Bhardwaj predict and quantify in the short term.

Get ready for higher volatility in markets

Despite the correction, the domestic

G

lobal equity markets are caught markets appear expensive. Based on the

The rise in VIX or Fear Index indicates rough weather ahead for stocks.

in a perfect storm of liquidity 12-month forward PE multiple, the Nifty

tightening by central banks, is currently trading at a 62.5% premium 18,500 Nifty NSE VIX 35

the Ukraine crisis, slowdown in to the MSCI Emerging Market index and

China’s demand, rising global 13.4% higher than the MSCI World index.

18,000 30

inflation and hike in interest rates. The The global macroeconomic stress is

MSCI World and MSCI Emerging Markets reflected in the IMF’s latest forecasts. It

22.74

indices have lost 17.5% and 16.4% respec- expects world economic growth to slow 17,500 25

tively in 2022. The Indian markets also saw down in the next two years and has lowered 17,625.7

heavy selling in the past few weeks, with its growth projections by 80 and 20 basis

17,000 20

the Nifty losing 8.9% and Nifty Midcap-100 points in its April 2022 World Economic

losing 10.4% this year. Small-caps were the Outlook report. It also expects global infla-

worst hit: the Nifty Smallcap 100 fell more tion to surge due to the war-induced jump 16,500 15

16.45 16,259.3

than 21% in 2022. Nearly 64% of the 4,000 in commodity prices. IMF’s 2022 inflation

BSE scrips have fallen in 2022, while the projections in advanced economies and 16,000 10

volatility index (NSE VIX) has surged 51%. emerging markets stood at 5.7% and 8.7%

A recent Cholamandalam Securities respectively, 1.8 and 2.8 percentage points

15,500 5

report advises investors to stay cautious as higher than projected last January.

it sees major risks to the domestic markets The concerns of rising inflation can 3 Jan 2022 3 May 2022

from external factors which are difficult to be assessed by looking at the global

cover ssttoorryy

The Economic Times Wealth May 23-29, 2022 03

bond yields. The 10-year bond yields of Commodities Market Outlook report for Weak macro readings

developed countries like the US, Canada, April 2022 sees major supply disruptions The latest industrial production numbers for March 2022

France, Germany, Italy and Spain have due to the Russia-Ukraine war and expects show lacklustre growth. The demand for consumer durables

jumped over 100 basis points in the past 6 non-energy prices to rise by about 20% in and non-durables continues to contract due to price hikes

months. Emerging economies like Brazil, 2022, with the largest increases in com- taken by producers to mitigate the input cost inflation.

Mexico, India, Indonesia, South Korea and modities where Russia or Ukraine are The performance of other sectors like capital goods and

Malaysia also saw 10-year bond yield jump key exporters. It expects the price of Brent infrastructure has also moderated. According to a report

by more than 80 basis points in the past six crude oil to average $100 a barrel in 2022, by AnandRathi, rate hikes can further complicate the situ-

months, according to Bloomberg data. 40% higher than last year. ation by depressing industrial productiwon. An Emkay

Here are the factors impacting the per- The Bloomberg Commodity Index which report says the rising input costs could impede the recovery

formance of domestic equity markets. tracks the global prices of oil, natural gas, through both lower corporate profits and consumption.

copper, zinc and other commodities surged Other macro data also point at the stress. According to data

FIIs exit as risk premiums fall 40% in the last one year and over 29.4% from the Commerce Ministry, India’s core sector growth

The rise in domestic bond yields has led to in the year 2022 so far. Back home, India’s slowed to 4.3% in March compared to 6% in February. On

the contraction in the risk premium, which wholesale price inflation hit a record high the other hand, India’s labour force participation rate fell to

is making equities unattractive. The risk at 15.08% in April fuelled mainly by the 40%, compared to the previous low of 47% in 2016, indicating

premium is the return expected from equi- rise in prices of mineral oils, basic metals, increased unemployment.

ties over the risk-free rate. India’s 10-year petroleum & natural gas, chemicals, food

bond yield shot up to a 3-year high after the and non-food products.

RBI raised the repo rate and cash reserve This has pushed up the operating costs

High inflation is here to stay

ratio to control inflation. It is now 7.32%. of companies and hit their profitability.

The 10-year US bond yield also shot up and Not all companies are able to pass on the

Higher input costs will put pressure on manufacturers.

is currently at 2.9%. increased costs due to the risk of demand

The spread between the Nifty earnings destruction. “Any disruption and demand

145 Bloomberg Commodity Index 16 WPI Inf lation (%)

yield and US 10-year bond yield has come destruction on account of higher prices

down since the start of 2022. The earnings will impact sales volumes for companies, 135 131.71 15 15.08

yield is calculated by taking the inverse leading to further pressure on operating

of the PE ratio. If PE ratio of an index is margins,” says a Motilal Oswal report.

125 14

20 times, its earnings yield will work out The raw material costs as a percentage

to 5% (1/20). This spread, calculated by of sales for BSE200 Index companies have

115 13

subtracting the US 10-year bond yield from gone up from 35.6% in December 2020 quar-

Nifty earnings yield, stood at 1.85% in ter to 39.4% in the December 2021 quarter.

105 12

the second week of May 2022 compared to Out of 77 of BSE200 companies (excluding

2.61% in January (see chart). banks, finance and insurance) that have

95 11

This decline in the spread is one of the declared the March 2022 quarter results so

reasons for the significant foreign inves- far, 45 companies (or 58.4%) have witnessed 10.74

85 93.25 10

tors’ outflows. It has made the US markets a contraction in EBITDA margins com-

more attractive to foreign investors. FIIs pared to the December 2021 quarter and 57 17 May 2021 17 May 2022 April 2021 April 2022

remained net sellers of Indian equities companies (or 74%) have seen a contrac-

Weak macro numbers are worrisome

for the seventh straight month in April tion in EBITDA margins compared to the

2022 and sold over $17 billion (`1.3 lakh March 2021 quarter.

Industrial production and core sector growth continue to be low.

crore) worth of Indian equities in the first Sectors like autos, cement, chemicals,

four months of 2022. According to a Kotak and consumer durables are hit the most Industrial production (%) Core sector (%)

30

Securities report, FII holding (including due to rising input costs. On the other

27.61

ADR and GDR) in the BSE-200 Index de- hand, higher energy prices is impact-

clined to 22.4% in the March quarter from ing the power, petrochemicals and gas 25

23% in the December quarter. The FII sell- distribution sectors by pushing up their

ing spree continued in the month of May operational costs. The fertiliser sector is 20

2022 with net equity outflows of over $3.7 also impacted because natural gas is used

16.44

billion up to 17 May (see chart). as a feedstock in urea manufacturing.

15

However, the sector is protected by govern-

Rising infl ation = higher costs ment subsidies. Moreover, if the rise in fuel

The prices of commodities used by manu- prices not fully passed on to the consumers, 10

facturers are surging. A World Bank oil marketing companies will get hit. 4.33

5

1.85

0

Risk premium down for foreign investors

May 2021 Mar 2022

FIIs have been net sellers in equities for the past eight months.

Falling rupee adds to woes

Net FII inf lows in equity ($ million) Avg risk premium to foreigners (%)

Will push up the import bill and hurt companies with foreign debt.

2,0001,529 2.9

1,000 2.7 72 Rupee vs $ 106 US Dollar Index

73.22

0 -3,6812.5 104 103.42

73

102

-1,000 2.3

74 100

-2,000 2.1

98

-3,000 1.82 1.9 75 96

-4,000 1.7 76 94

1.73 92

-5,000 1.5 77

Chart in inverted scale 90

-6,000 1.3 78 77.56 8890.16

May 2021 May 2022

17 May 2021 17 May 2022 17 May 2021 17 May 2022

cover ssttoorryy

04 The Economic Times Wealth May 23-29, 2022

Rupee in free fall and concerns of rising inflation. India downgrades for 2022-23 earnings esti- with `1.25 lakh crore inflows in 2021-22,

The rupee touched a low of 77.72 against the meets most of its oil requirements through mates. Over 67% of the companies in the a growth of 29.6% year on year. This

US dollar in May, depreciating by over 4% imports and rising oil prices increase the BSE200 Index (184 for which Bloomberg massive inflow indicates the continuing

in 2022 so far. On the other hand, the Dollar import bill. The latest NSE Market Pulse earnings estimates are available) have interest from retail and HNI investors.

Index which measures the strength of the report forecasts a widening of current witnessed downgrades in adjusted EPS Interestingly, SIP inflows have remained

US dollar against other major currencies, account deficit by 170 basis points to 3.5% consensus estimates for 2022-23 in the past strong despite weak equity markets.

has jumped by over 9.3% in 2022. in 2022-23 if crude prices average $100 per three months. “The equity segment saw net inflows of

The rupee is losing due to a surge in oil barrel. Though Indian equity markets are `15,600 crore in April compared to `28,300

prices, subdued industrial production data The weakening rupee will also increase volatile due to macroeconomic concerns, crore in March. Funds raised in NFOs

the cost of imported raw materials which some analysts remain confident about its were merely at `3,100 crore, indicating

in turn will hurt the operating profit mar- long-term prospects. According to a recent strong flows in the existing schemes.

GDP growth gins of companies. Also, companies will Jefferies report, Indian stocks remain Equity funds across all cohorts saw net

find it difficult to service the debt raised in Asia’s best long-term structural story in inflows and equity AUM grew 5% m-o-m to

forecasts lowered foreign currency. As the rupee weakens, terms of equities. The report lists strong `13.9 lakh crore despite weak equity mar-

Bloomberg analysts have one needs more rupees for trading the tax revenues, rising government capital kets,” says a Motilal Oswal report.

downgraded GDP growth same US dollar and therefore the cost of expenditure (central government’s capex

interest servicing rises. to GDP ratio rising from 1.6% in 2019-20 to Decent Q4 numbers so far

forecasts in the past few weeks.

2.9% in 2022-23), and reforms like the per- There is good news coming from the

Downgrade in GDP forecasts formance-linked incentive (that aims to boardrooms of India Inc. Till now, 32 com-

7.85 GDP growth (%)

The worsening macroeconomic issues support the manufacturing sector) as key panies in the Nifty index have declared

7.8 have led to analysts downgrading their factors that will contribute to the success of fourth quarter results. For 28 companies,

GDP forecasts for India. Morgan Stanley, Indian equities. There are other signs too. Bloomberg consensus estimates for ad-

7.75

the World Bank and even the RBI have re- justed EPS are available. Out of these, 18

7.7 vised their GDP growth forecasts for 2022- Strong domestic infl ows companies (or 64%) have reported adjusted

7.65 23. Morgan Stanley expects the GDP to Domestic mutual funds continue to par- EPS higher than the Bloomberg consensus.

77..66 grow by 7.6%, down from 7.9% earlier. The tially absorb the selling pressure of FIIs. Only 10 companies were below consensus.

7.6

World Bank expects 8% growth, compared Inflows have remained positive since June Private banks reported improved per-

7.55 with 8.7% projected earlier. The RBI ex- 2021. In the first four months of 2022, do- formance due to an improvement in asset

77..55 pects 7.2% growth, down from 7.8% earlier. mestic institutions invested `89,259 crore quality and moderation in credit costs. The

7.5

Such downgrades reflect the uncertain- in equities (see chart). According to a Kotak IT sector is supported by a strong demand

7.45 ty regarding the recovery of consumption Securities report, the domestic institution- environment and good deal wins. The

7.4 and investment demand as rising interest al investors holding in the BSE 200 Index automobile sector also reported a good set

rates could impact the industrial capex or increased from 13.4% in the December of numbers helped by price hikes and op-

7.35

could delay or weaken consumer spending. quarter to 14% in the March quarter. erating leverage. However, the sector will

3 Jan 2022 17 May 2022 Most companies have also witnessed SIP inflows also continue to be robust, continue to face margin pressures due to

the rising raw material costs.

Record GST collections

Mutual fund inflows continue to be robust

There is some more good news. GST collec-

Domestic investors have f illed the vaccum created by exiting FIIs. tions hit a record high of `1.68 lakh crore in

the month of April, a 20% growth from last

Net equity fund inf lows (` crore) 28,181 year. “The total number of e-way bills gen-

erated in the month of March 2022 jumped

24,095

21,502 21,923 22,220 22,371 13% on a MoM basis, which reflects the re-

covery of business activity at a faster pace,”

according to the Finance Ministry release.

16,488

14,993 Tax revenues grew 34% y-o-y in 2021-22 to

`27.07 lakh crore indicating a good econom-

9,792 ic recovery. “This revenue growth has been

7,701 7,683 propelled by rapid economic recovery after

6,437

successive waves of Covid,” says another

release from the Finance Ministry.

-194

May 2021 Jun 2021 Jul 2021 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021 Jan 2022 Feb 2022 Mar 2022 Apr 2022 May 2022

GST collections at

*May data up to 12 May 2022

record high

Indian investors keep faith in markets Indicates that business has

started booming again.

High SIP inf lows indicate that investors are not worried by volatility.

12,328 1.7 GST collections (` lakh crore)

SIP inf lows (` crore) 11,863

11,305 11,517 11,438 1.68

11,005

10,351 10,519 1.6

9,609 9,923

8,596 8,819 9,156 1.5

1.41

1.4

1.3

1.2

1.1

1.0

0.9

Apr 2021 May 2021 Jun 2021 Jul 2021 Aug 2021 Sep 2021 Oct 2021 Nov 2021 Dec 2021 Jan 2022 Feb 2022 Mar 2022 Apr 2022

Source: AMFI Apr 2021 Apr 2022

investing

The Economic Times Wealth May 23-29, 2022 05

“Invest in mid and small caps

through SIPs, not lumpsum”

Equity markets in India will continue to remain volatile till the US Fed decides that it is time

to step away from fighting inflation, Sankaran Naren tells Sanket Dhanorkar

are at this point of time. The longer term tackling inflation and focuses on growth

curve has already become higher, while like they did in December 2018. So we are

we don’t discount the possibility of it going big believers in asset allocation and in

further up. At least the longer term curve volatility in equities and in debt markets.

reflects higher rates even now, unlike the Consequently, we think that a systematic

shorter term curve. approach, along with following asset al-

location techniques and investing in asset

What is your take on the impact of the allocation funds / multi asset strategies

weakening rupee and rising cost infl ation which involves investing across categories

for India Inc? Do you expect sharp earn- is the best way to navigate the current vola-

ings downgrades? tile markets. We believe that investors who

We believe that while some commodity ori- have not bothered to focus on risk manage-

ented companies are likely to benefit from ment are likely to get hurt in this period of

this trend, others are going to get hurt. So the market.

there will be areas where there would be

earnings upgrade and in other areas we What is your take on the rout in the big

could witness earnings downgrades. We tech names globally? What is the best ap-

believe that export oriented companies proach for investors in global funds?

in some cases would be beneficiaries of We believe that investors who are invested

the weakening rupee at this point of time. in global funds should not redeem at this

We recommend funds, which are focused point of time and invest in category like

on exports and services, passive multi-assets for

considering that in India, “Investors who investing in global funds be-

services sector is less hurt cause the global stocks have

by increasing cost infla- have not bothered corrected much more than

tion and also benefits due Indian stocks.

to focus on risk

to this trend.

How do you perceive value

management are

Is this likely to put a halt in some of the new age in-

to the recent uptick in likely to get hurt in ternet businesses that listed

the value segment of the amid fanfare recently?

market? this period of the Some of these listings cor-

Usually, it is globally rected substantially. Since

market.”

believed that a sharp in- most of the New Age and

crease in interest rate Internet businesses have

aids the value segment in the market as not been listed, we are happy as a mutual

compared to the growth segment. So we fund industry that as and when they list

are still believers in the near term out-per- in future, they will be at more reasonable

formance of the value segment relative to valuations. We will get the benefit of more

the growth segment. Yes, the segment has reasonable valuation given that the first

fared well in recent times. We also believe few listings in this segment have seen loss-

that this trend will likely continue in the es for many investors. We hope, therefore,

near term. that issuers and investors are likely to be

more reasonable in valuation techniques

Sankaran What is your perception of the market sell Is the mid- and small-cap space ripe for that they adopt in future instances.

off? Do you expect more pain ahead or a bargain hunting now?

Naren

quick rebound? We don’t believe that it is yet time for big What is the ideal approach to debt fund

The US Federal Reserve Chair Jerome lump sum investments in small- and mid- investing today?

ED & CIO, ICICI Powell believes that fighting inflation is the cap space. We think that the next few years People believe very often that in periods

most important thing at this point of time. would mark volatility in stocks in the of increasing interest rates, it’s difficult to

Prudential AMC

Consequently, we believe that equity markets segment. Hence, it merits a systematic ap- find appropriate products in the debt mutu-

will continue to remain volatile till the US Fed proach like SIPs rather than lump sum at al funds. But we believe that floating inter-

decides that it is time to step away from fight- this point in time. est category is a very interesting category

ing inflation. But this does not rule out possi- which benefits out of such an environment.

bilities of periodical relief rallies. What are the big calls you’re making in And unlike decades ago, we are in a posi-

your equity and asset allocation funds tion to benefit out of increasing interest

RBI has fi nally kick-started the rate hike amid the current market correction? rate regime but only if investors choose to

cycle. How do you expect the interest rate Since the market touched 60,000 level in invest in this category.

trajectory to play out and its impact? September 2021, our call has been that we

We believe that short-term interest rates are are in for a period of volatility. We believe

Please send your feedback to

likely to continue to go up significantly / have that this period of volatility will end once

[email protected]

much more scope to increase from where we the US Federal Reserve decides to stop

guest ccoolluummnn

06 The Economic Times Wealth May 23-29, 2022

A crypto blow up, the

first among many

The price of a cryptocurrency hits rocks bottom, leaving investors

with nothing. But why are people surprised, asks Dhirendra Kumar.

S

omething called Luna,

which is (was?) apparently a

cryptocurrency, fell by 99.98%

DHIRENDRA KUMAR

in about a week’s time. Actually,

CEO, VALUE RESEARCH

the arithmetic of the fall was

money tremendously entertaining as well as

educational. It fell 96.7% over four days and

mysteries

then fell another 99.3% over the next two

days. Presumably, the currency’s full name

is ‘lunatic’ and it’s named after people who

invested in it. If stories in the media are to be

believed, there were many Indians who had

invested in this thing. If your holding was

worth `1 lakh on 5 May, then you might still

There are people

be able to buy a samosa with it, provided you

who are saying that

don’t go to an expensive place.

since crypto has As I’m writing this page, I can hear TV an-

fallen so much, it is chors screaming about the staggering loss-

better value now. es. However, I don’t think these losses are

This is perversion staggering at all. In fact, they are not even

mildly surprising—they are exactly what

of what ‘value’

one should have expected from this crypto

means in investing.

nonsense. This is just one so-called cur-

There is no ‘value’

rency—such things will be routine across

in an investment the entire crypto wasteland in the days and

in which there weeks to come.

is no underlying

The only reason that is

economics.

there to buy cryptos is the

price and so if the price

falls, then that reason only

gets weaker.

The best comment I read on social media

about crypto was this: Sick of people calling

everything in crypto a Ponzi scheme. ES

G

Some crypto projects are pump and dump A

M

schemes, while others are pyramid schemes. YI

T

Others are just standard issue fraud. Others ET

G

are just middlemen skimming off the top.

Stop glossing over the diversity in the Nicholas Taleb tweeted this: For a conta- but the business parameters of many fun-

industry. However, I don’t actually intend gion driven asset with no economic anchor damentally sound businesses are stable

to write about this thing today—there’s such as #BTC, a falling price does not make or improving. That makes them a better

nothing new in it and there is no sense in it “cheaper” and more attractive. A falling value for investors. That’s pretty much

engaging with the sort of people who are price makes it less desirable and, paradoxi- what value means in investing.

obsessed with all this. I just hope that the cally, more expensive. Why? Because price Cryptocurrencies have no such underly-

kind of tax structure that this year’s budget is its ONLY information. ing economic logic. The only reason that

brought in for crypto currencies means that If you think about what he means by is there to buy is the price and so if the

relatively few Indians will be impacted in saying that ‘price is its ONLY information’ price falls, then that reason gets weaker.

the crypto disaster. then you will understand the whole story There is no way to calculate value. It’s a

The most mind boggling idea is that inves- effortlessly. The stock price of a company gamble, pure and simple. There is nothing

tors should stick to ‘conservative options’ has an underlying financial logic. That else there. On top of that are the issues like

like Bitcoin instead of fringe ones like Luna. logic arises from its business track record, taxation and the need to trade through

Strangely, even today, there are plenty of the profits it makes and will continue to shadowy entities that are self-declared ex-

people who are saying that since crypto has make in the future. This means that if the changes but which have no one regulating

fallen so much, it is much better value now. stock price falls and the business param- them. If you still want to gamble, go ahead

This is a complete perversion of what ‘value’ eters remain the same or improve, the but don’t say that no one warned you.

means in investing. There is no ‘value’ in an stock becomes cheaper and therefore more

investment in which there is no underlying desirable to buy. In fact, that’s exactly what

economics. Some weeks back, at the begin- is happening in the Indian stock markets Please send your feedback to

[email protected]

ning of the current crypto crash, Nassim nowadays. The stock prices are crashing

review pprreevviieeww

The Economic Times Wealth May 23-29, 2022 07

Fuel, veg prices Irdai rap for motor

NEWS IN BRIEF

see high inf lation

insurers over ads Indian crypto exchanges

face rough times

Indian cryptocurrency exchang-

Wants ads showing services not part of cover removed. es are set to face lower valuations,

longer negotiation cycles, and

hard bargaining by venture capi-

Regulator Irdai has asked motor insurance

tal firms due to dipping trading

providers to discontinue advertisements

volumes, talk of more restrictive

showing services, like free pick up and drop

tax regulations, and the impact of

of vehicle, which are not part of the insurance

the Terra Luna collapse on retail

Cabbage, raw cotton, radish and the cover. General insurance companies

investors. Market watchers say

humble karela saw the highest whole- enter into service agreements with motor

at least six transactions are stuck

sale inflation in April and together workshops/garages for the purpose of

due to valuation mismatches

with kerosene, liquid ammonia, avia- providing motor insurance claim services for

between crypto platforms and

tion fuel, and natural gas, drove the repair of accident vehicles. investors and strategic buyers.

price rise to a record 15.08% in April. Irdai said it is noticed that the service Trading activity, which ac-

While the wholesale inflation in agreements in addition to claim services, counts for the bulk of revenue at

kerosene was 118.2% y-o-y in April, extend certain assistance services not related exchanges, will shrink further

that for cabbage and bitter gourd was to insurance claims such as free pick up and when tax deducted at source

in high double digits at 88.3% and drop of vehicle, body wash, interior cleaning, (TDS) kicks in on 1 June, squeez-

75.4%, respectively. The high infla- inspection of vehicle etc. ing profit or even leading to loss-

tion in the food and fuel basket may “While the bundling of (such) facilities es for players with higher costs.

put pressure on household budgets with insurance is left to the motor service

and drive down the consumption of providers, the general insurers issuing claims as may be provided by motor garages/ Uber fare hike

discretionary goods such as mobile advertisements on the said services, workshops”. Ride-hailing app Uber India

phones, leisure and travel. projecting them as benefits provided within They have also been asked to stop display- has said it has, over the past few

The wholesale price index (WPI) the insurance cover is unacceptable,” the ing discounts with reference or comparison to weeks, raised fares to cushion

measures price rises in 697 items, Insurance Regulatory and Development rates of erstwhile tariff. drivers from the impact of rising

of which 564 are manufactured Authority of India said in a circular. Irdai noted a perusal of advertisements fuel prices. The company said it

products. High wholesale inflation The main objective of service agreements issued by a few general insurers showing dis- always strives to make driving

has impacted retail prices, driving with motor garages/ workshops shall only be counts up to certain percent, saving in the pre- with Uber a viable and attractive

consumer inflation to an eight-year providing insurance services for claims of mium, and the illustrations provided therein, option for drivers, and added

high of 7.79%. accident vehicles and it cannot arbitrarily ex- reveals that the features or benefits are appli- that “the recent hike in fares will

“Most of these items impact house- pand to include scope of services which are not cable under extreme or exceptional scenarios. directly boost their earnings per

hold budget and a rise in inflation relevant for insurance claims, it said. The discounts in certain advertisements trip”.

will constrain their disposable in- The regulator has asked the insurers “to are not shown objectively on filed rates but ex-

come and demand,” said ICRA chief discontinue the advertisements in respect pressed in comparison to rates of erstwhile tar- Most expensive car

economist Aditi Nayar. of the services not related to insurance iff, Irdai said, and added this is not to be done. A 1955 Mercedes-Benz, one of

only two of its kind, was auc-

tioned off earlier this month for

a whopping 135 million euros

Axis MF sacks

Top executives may get ($143 million), making it the

most expensive car ever sold,

chief trader

RM Sotheby’s has announced.

The Mercedes-Benz 300 SLR

9% hike, fi nds survey

Axis Mutual Fund has asked chief trad- Uhlenhaut was sold to a private

er and fund manager Viresh Joshi to collector, fetching almost triple

leave the firm following a probe into the previous record price for a

alleged wrongdoings by him. car, which was set in 2018 by a

1962 Ferrari 250 GTO that went

Top executives in India are expected to Pay at risk, the sum of variable The fund house was investigating

for over $48 million.

receive an increment of 8. 9% this year, pay and long-term incentives to total whether two fund managers—Viresh

the highest in six years, according to a compensation for CEOs is pegged at Joshi and Deepak Agarwal—were

survey. The meatiest hikes are expected around 60%, while C-level executives involved in front-running, received

to be witnessed in sectors such as including the COO, CFO, sales head kickbacks and executed trades that

manufacturing, technology and and chief human resources were detrimental to the interests of

ITeS, followed by life sciences officer follow close behind the unitholders. Earlier this month,

and finance. at 50%, showed data the fund house had suspended Joshi

“Over the last few from 475 companies and Agarwal as it was investigating

decades, a large across more than 20 “potential irregularities.” In its latest

percentage of India industries. statement on the dismissal of Joshi,

Inc has turned to These buoyant Axis did not name Agarwal. It could

outside talent instead trends mean that not be ascertained if the charges

of building from robust salary hikes against Agarwal have been cleared.

within. In the wake of are expected over “Axis AMC has been conducting

the pandemic, however, the next two years, a suo moto internal investigation

talent is in short supply while roles connected since February 2022, using reputed

and the cost of attracting, with the future of work external advisors to assist with this

retaining and engaging will be highly valued. “Not ongoing investigation. Further to our

leadership talent that grows business only is the average executive investigation, his conduct and fol-

is rising rapidly,” said Nitin Sethi, compensation increase the highest in lowing the decision to suspend him,

partner and CEO, India for Human five years, but variable pay and equity the employment of Mr. Viresh Joshi

Capital Solutions at global human grants have also risen as companies has been terminated with effect from

resource consulting company, Aon, cannot risk losing key talent at senior May 18, 2022,” said an Axis MF state-

which conducted the survey. levels,” said Sethi. —John Sarkar ment. Joshi has been working with

the fund house since 2009.

investing

08 The Economic Times Wealth May 23-29, 2022

What ails India’s ETF industry?

Lack of liquidity in underlying stocks is leading to distortion in prices, negatively impacting investors.

by Himadri Buch

F

or sometime now, prices of lem-

ons have been at the centre of

some tart discussions. Experts

say unconducive weather and

a heatwave across the country

forced prices up. But it boiled down to an

imbalance between demand and supply.

This imbalance is what controls prices and

markets for the tangible and intangible.

Exchange-traded funds (ETFs) are ailing

because of this imbalance. As a result,

there is lack of liquidity in India’s ETFs.

To be sure, ETFs in India are spreading

wings. In July 2021, the 100th ETF got listed

on NSE, but it took 19 years to hit the cen-

tury. Liquidity has been a cause for worry.

The Motilal Oswal Nasdaq 100 ETF, with

assets at `6,130 crore, is trading at `104.50

or 9% premium over its NAV. The Hang GETTYIMAGES

Seng BeES, managed by Nippon Life India

AMC, with assets of `88 crore, is trading

Tracking liquidity of some prominent ETFs

at a premium of 18% over its NAV, with the TTML (6.31%), have the highest impact

market price at `305. This difference in costs in the top 500 stocks on the NSE. Both

NAV and market price happens because of PRICE AS ON 6 AVERAGE these stocks have given very high returns

BROAD MARKET ETFS VOLUME

an imbalance between demand and supply. MAY 2022 VOLUME in the past year, but they are illiquid. These

Currently, ETFs tracking international Nippon India ETF Nifty BeEs 177.94 95,09,041 48,39,113 illiquid stocks made the ETF illiquid.

indices have to cap their investments at $ Interestingly, the Kotak Nifty Alpha 50

1 billion in foreign stocks and these funds SBI-ETF NIfty 50 168.76 9,74,501 5,05,541 ETF did not hold these two stocks, violat-

are not allowed to create new units by rais- ing Sebi guidelines that an ETF should rep-

SBI-TF Nifty Next 50 423.46 95,888 39,564

ing new money. But since they continue to licate the full index. As the fund did not buy

trade on NSE as well as BSE, their prices ICICI Prudential Nifty 100 ETF 181.99 17,582 15,838 16% of the index holding in the ETF, it led

are distorted vis-à-vis their NAVs. to a tracking error of almost 3%. Market-

Nippon India ETF Bank BeEs 348.58 19,51,542 10,01,483

While international ETFs on Indian makers will also refrain from providing

exchanges have a regulatory problem, the MOST Shares N100 ETF 104.57 9,76,633 4,51,848 liquidity to an ETF which is illiquid.

fact is Indian ETFs have always had dis- New fund houses are also not too keen on

torted prices. This problem is getting seri- MOST Shares Q50 ETF 51.24 41,012 19,878 launching ETF products, as they feel the

ous because investors are now demanding liquidity crunch will spook investors.

Mirae Fang+ETF 41.31 8,93,561 7,00,001

ETFs on various indices. There are now a For retail interest to grow in ETFs,

slew of ETFs that are launched on indices Mirae S&P Top 50 26.84 2,57,663 2,18,413 listed-units trading is the alternative to

that are related to factors like quality, al- accumulate ETFs from exchange. In India,

pha, value, or size, where the underlying is Mirae HK Tech Index 13.84 2,68,904 4,87,029 while clearing investment documents of

not liquid, leading to distortion of prices. ETFs, Sebi requires a minimum of two

Nippon India ETF Hangseng BeEs 305.95 Low volume 1,803

While there is no easy solution for this, market-makers to create liquidity per ETF

the right thing for most investors is to sim- Source: Indian ETFs and Index Funds by giving two-way buy and sell quotes on

ply follow a market-cap index like the Nifty the exchange for listed ETFs. This is ex-

50 and the ETFs based on it like the SBI ETFs today is mostly due to lack of aware- than index funds,” says Ravi Saraogi, co- pected to help retail accumulate and exit

Nifty 50 ETF or the Nippon Nifty BeES. ness of ETFs in the retail segment. In addi- founder, Samasthiti Advisors. ETFs when desired. Although listing ETFs

But even here, in times of extreme draw- tion, most of the large buyers of ETFs tend He feels that even in prominent ETFs, is beneficial to retail investors operation-

downs, these ETFs have failed to meet to skip the exchange and go directly to the there are times when the exchange price ally, there is a flip side to exchange listing

investors’ expectations. Anish Teli, man- AMC,” says Pratik Oswal, head - passive shows volatility over the NAV. Smaller and of ETFs when the listed price goes at a pre-

aging partner of QED Capital PMS, says, funds, Motilal Oswal Asset Management. newer ETFs with thin trading volumes will mium or discount to actual NAV of the ETF.

“In India, the structure of the ETF market In India liquidity is a big deal. Leaving require significant market-making sup- At premium, the ETF buyer is left with less

is a problem. ETFs can only be launched as aside the top 100 stocks, liquidity, which port from AMCs before retail investors can returns, while at discount, the ETF seller

a passive product. In the US, ETFs are more can be measured in impact costs, starts confidently invest in them. does not get the best realisable value.

tax-efficient than mutual funds, and there to fall. Faced with limited options, inves- Industry players say liquidity will be- If volumes increase to consistent healthy

are ETFs based on actively managed strat- tors want to pile on whatever products are come robust only if promotional activities levels on the exchange, domestic industry

egies. So, the underlying stocks and the available in the exchanges. This leads to a are done. Also Sebi must allow smaller will have ETFs that will be more efficient.

ETFs are traded every day and liquidity is premium over the NAV, resulting in a loss investors to come directly to the exchange AMFI needs to focus on making ETFs’

usually not an issue.” to the investor where he is buying a product as opposed to buying a basket, and regulate low-cost investing popular among retail,

According to NSE, during the last five with low costs, but ends up actually shell- ways to incentivise market-makers. especially ultra HNIs and HNIs. With deep

years, passive funds’ AUM has increased ing out a higher price. Sometimes liquidity scarcity is arti- pockets, these investors can buy or sell in

from `52,368 crore as on 31 March 2017, to “In index funds, you buy/redeem with ficial. For instance, an ETF launched by large volumes on exchanges that could pro-

`499,319 crore as on 31 March 31 2022 (an an- the MF company at NAV, whereas in ETFs, Kotak Mutual Fund in December 2021 pel higher consistent trading volumes.

nualised growth rate of 57%). you buy/sell at the exchange, where the called Kotak Nifty Alpha 50 ETF, based on

According to industry experts, EPFO last-traded price can deviate significantly the Nifty Alpha 50, holds mid- and small-

has 92% of passive funds and retail inves- from published NAVs. Thus, the total cost cap stocks that are often illiquid. Its top Please send your feedback to

[email protected]

tors hold only 2%. “Lack of liquidity in of ownership can be significantly higher holdings, Brightcom Group (10.46%) and

mutual ffuunnddss

The Economic Times Wealth May 23-29, 2022 09

FRONT RUNNING

DOESN’T HURT,

BUT IS UNETHICAL

Hall of Shame

Allegations of malpractices by mutual funds have surfaced

Front-running, insider trading and stock price

in recent times. We explain the modus operandi of the

manipulation–instances of malpractices are common

perpetrators and whether such malpractices hurt investors. in the investment world. Here are some recent cases:

May 2022

T

he allegations of front-running in too much in the large-cap segment. If a mutual

mutual funds may have shocked fund places a large purchase order of `20-30 Two fund managers of Axis Mutual Fund—Viresh Joshi and Deepak

investors, but observers are not sur- crore, it can make a big difference in the price Agarwal—were suspended after an investigation by the fund house.

prised. Front-running, insider trad- of a stock with a market cap of `2,000-3,000 They allegedly shared information about investment decisions

ing and misuse of information are crore. But a large-cap stock with a market cap with brokers in Gujarat in return for kickbacks. The two had assets

not uncommon in the investment world. In the of `50,000-60,000 crore may not get affected. disproportionate to their known income. Sebi is still investigating.

past 12 months alone, several such instances At the same time, some momentous develop-

have come to light (see box). ment like the merger announcement of HDFC

Dec 2021

Front-running is the illegal use of advance Bank and HDFC can make even large-caps

information leaked to brokers by mutual zoom. Derivative buyers would have made a Deutsche Mutual Fund fund manager Akash Singhania and his par-

fund staff. Tips on impending purchases give killing the day the merger news came out. That ents paid `5 crore to settle a case of alleged front-running. As the

the trader an advantage over others and is a the move was kept a closely guarded secret fund manager of Deutsche Mutual Fund, Singhania had knowledge

sure-shot way to make big money (see graphic). is an indicator of the corporate governance of impending orders of the fund house. He opened four trading

Leveraged buying can yield even bigger gains. norms followed by the HDFC group. accounts in the names of his parents—Ashok Kumar Singhania and

But this game is not as easy as it may sound. While front-running is both unethical and Premlata Singhania—who bought the scrips before the fund house

The dealing rooms of mutual funds and bro- illegal, it does not really hurt the common in- placed orders and sold them when prices rose. Sebi says they made

more than `1.4 crore prof its.

kerages are high security areas with strict vestor in stocks and mutual funds. Yes, the ad-

confidentiality rules. Dealers aren’t allowed to vance information is very potent and brokers

carry personal phones and must use recorded have made millions using this illegal market Jun 2021

phone lines. In the past two years, these rules practice. In 2019, two entities coughed up `10

have got diluted due to work-from-home. Also, crore to settle a front-running case. Just before Franklin Templeton shut its six debt mutual funds on 23

the stringent rules cannot stop an individual However, purchases by front-running rack- April 2020, some senior functionaries and their relatives reported-

from leaking the information after office eteers are not big enough to make a difference ly redeemed almost `30 crore worth of investments in the troubled

hours. So, although fund houses and market to the stock price. The front-runners make big schemes. Sebi termed this as misuse of non-public information and

imposed a cumulative penalty of `7 crore on Franklin Templeton

regulator Sebi keep a tight watch, the human money, but not at the expense of mutual fund

director Vivek Kudva, his wife Roopa Kudva, and other relatives.

element in the equation means they can’t com- investors. Sellers from whom the front-run-

The Kudvas have challenged the Sebi order.

pletely stop front-running. ners buy are possibly the only ones who lose

Though front-running works well in the out. They are not aware that a large purchase

mid-cap and small-cap stocks, it does not yield order will push up the stock the next day. May 2021

Sebi barred three individuals from accessing the capital market for

running a front running racket. Rakesh Shah, a dealer with Reliance

Modus Operandi

Capital Mutual Fund, Anita Shyam Mhatre, who had a trading account,

and Sanjay Parekh, a dealer with a brokerage f irm Anugrah Stock &

How front runners make their millions

Broking teamed up to run the racket. As a dealer with Reliance Capital

Mutual Fund, Shah knew about impending large trades. He passed

that information to Parekh, who used Mhatre’s trading account to

purchase securities. The three made around `8.87 lakh in prof its.

01 02 03

Feb 2021

TV anchor Hemant Ghai, his wife and his mother were barred from

Investment team of Fund house staffer who Broker or associate accessing the capital markets after Sebi found them guilty of price

a fund identif ies a knows this leaks this buys that stock in manipulation. Ghai used to recommend scrips in his TV show. He

stock and decides information to broker large quantity or takes had opened trading accounts in the name of his wife and mother.

to buy. or other associates. leveraged position. The shares were bought one day before the recommendations were

made and sold when the stock price went up after the show. Ac-

cording to Sebi, Ghai made an estimated `2.95 crore this way.

Jul 2020

06 05 04

Four entities were f ined `2 crore for front running at HDFC Mutual

Fund. The equity dealer of the fund house, Nilesh Kapadia used

to tip off Dharmesh Shah about impending orders at HDFC Mutual

Fund. Both were f ined `50 lakh each, while brokerage f irm IKAB

Broker or associate Stock moves up due Fund house places

Securities & Investments was f ined `60 lakh and Ashok Nayak was

sells stock, exits to large order from buy order with

f ined `40 lakh. The four were also barred from the capital markets.

leveraged position with fund house. broker.

Sebi estimated they made `1.75 crore from front running.

big prof its.